Auto eFNOL without log in

Auto eFNOL without log in

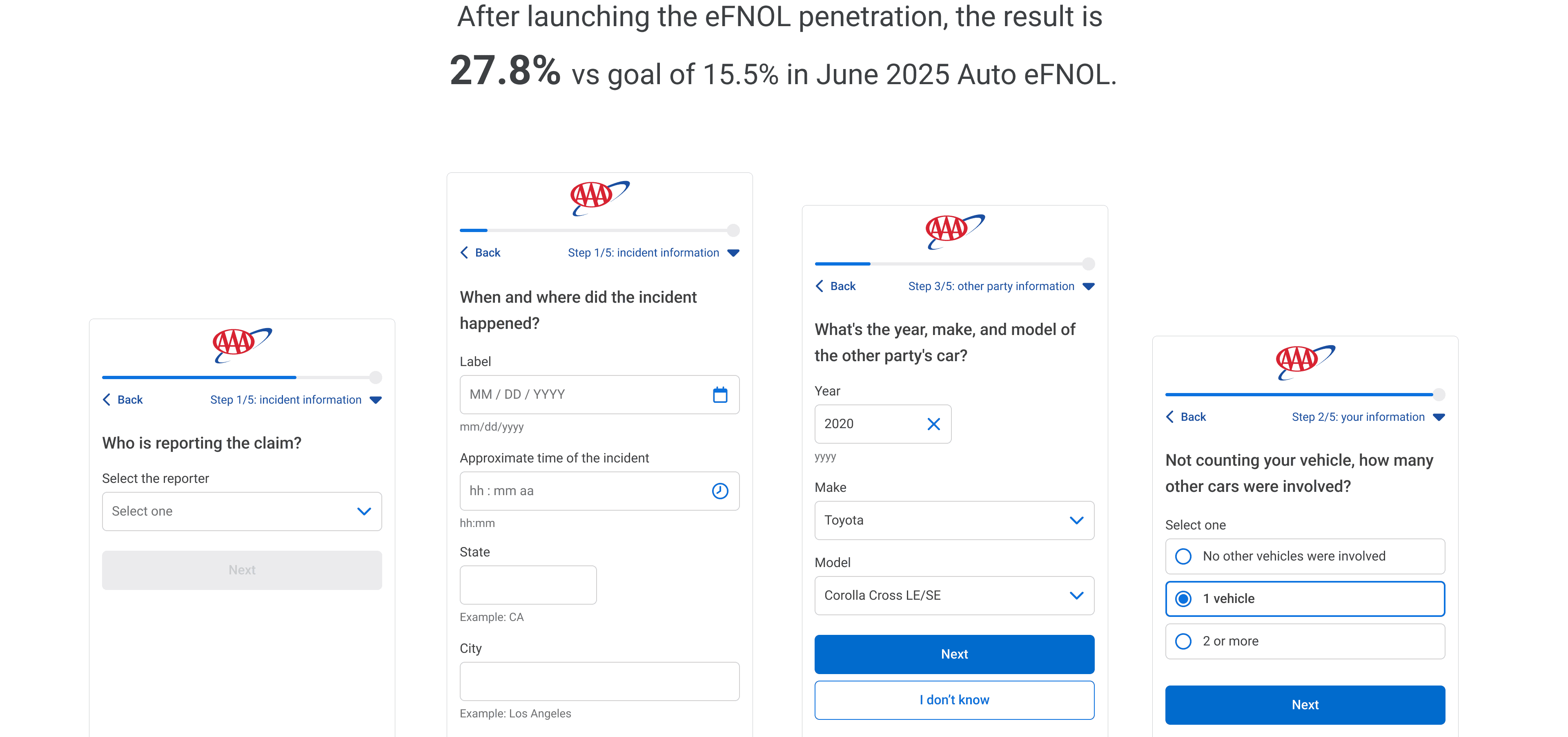

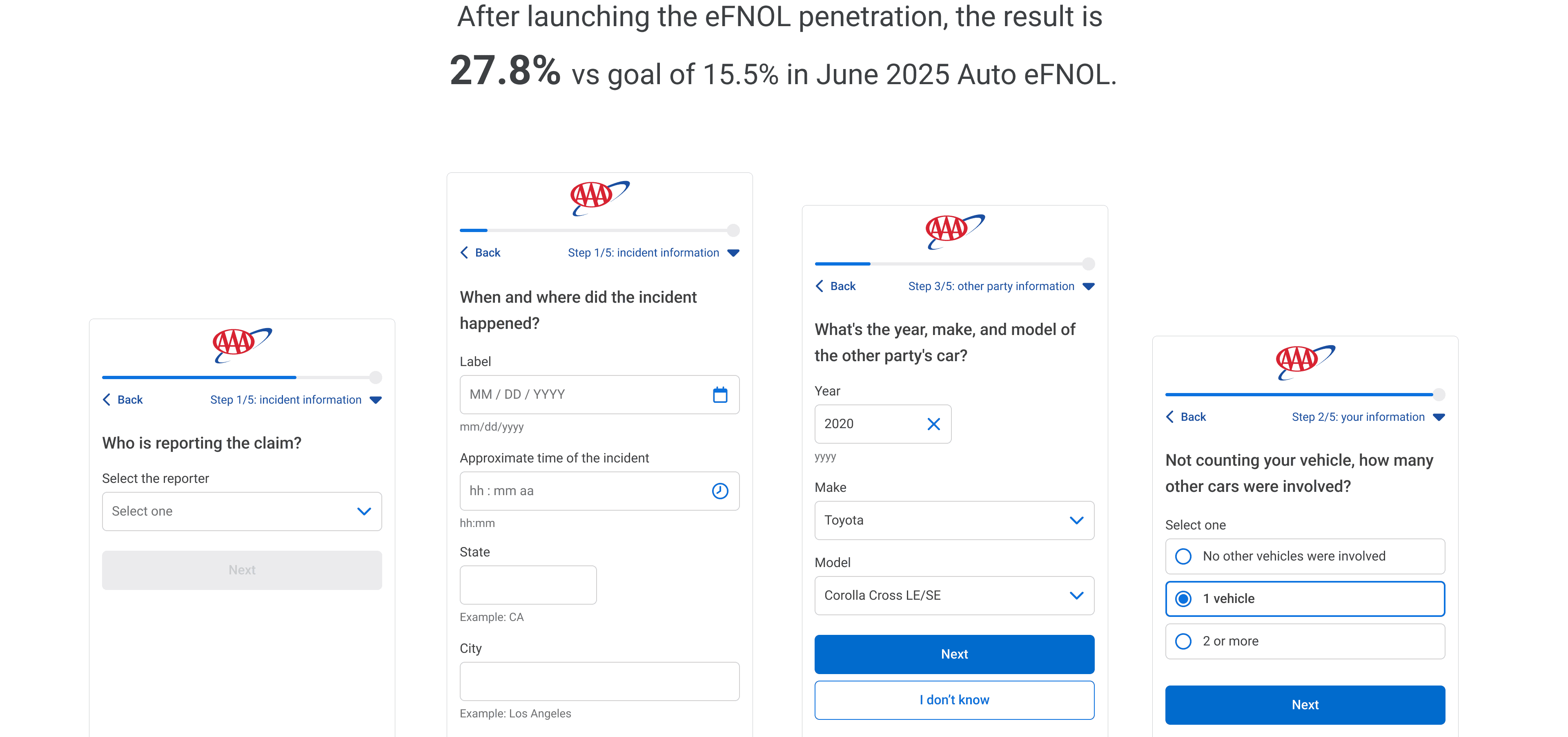

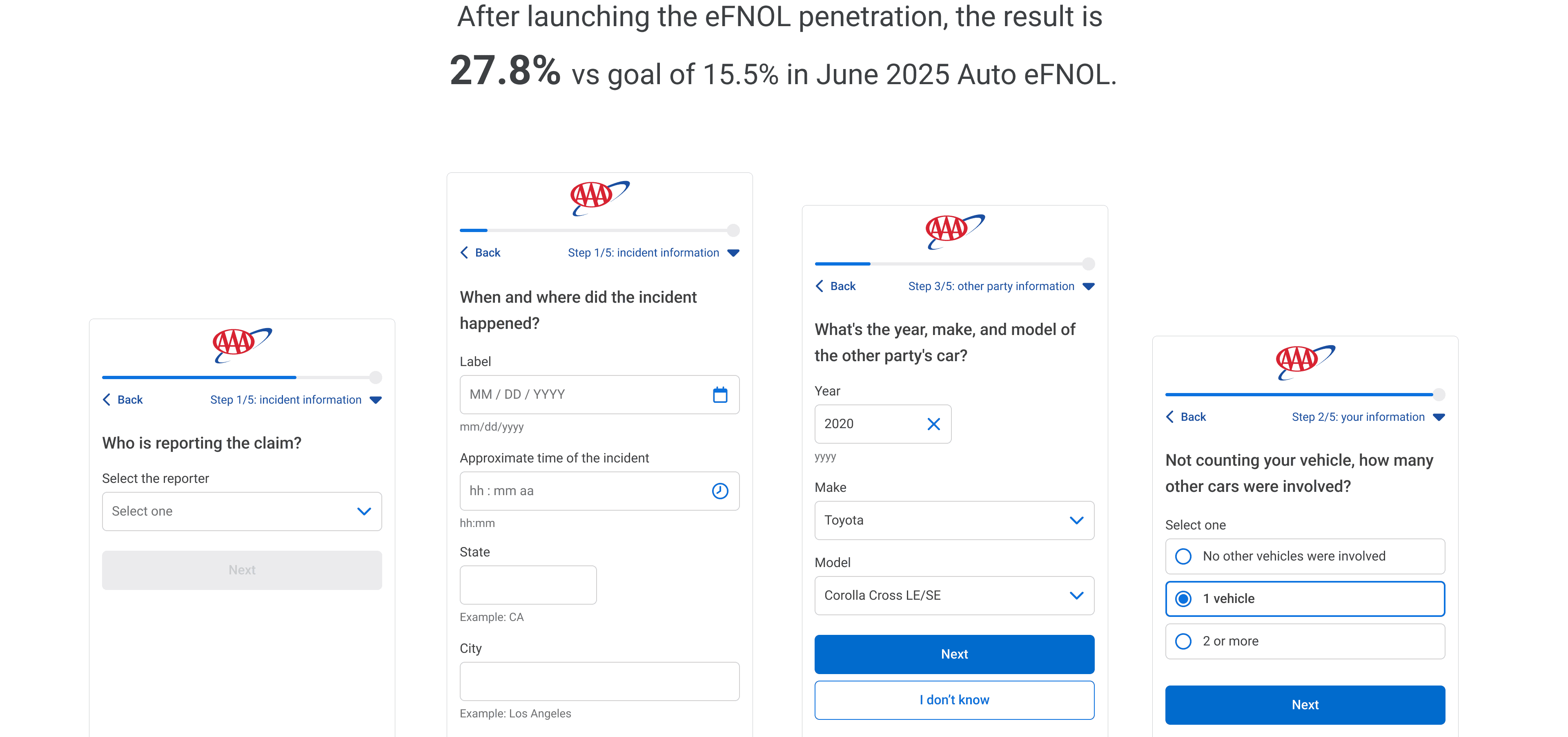

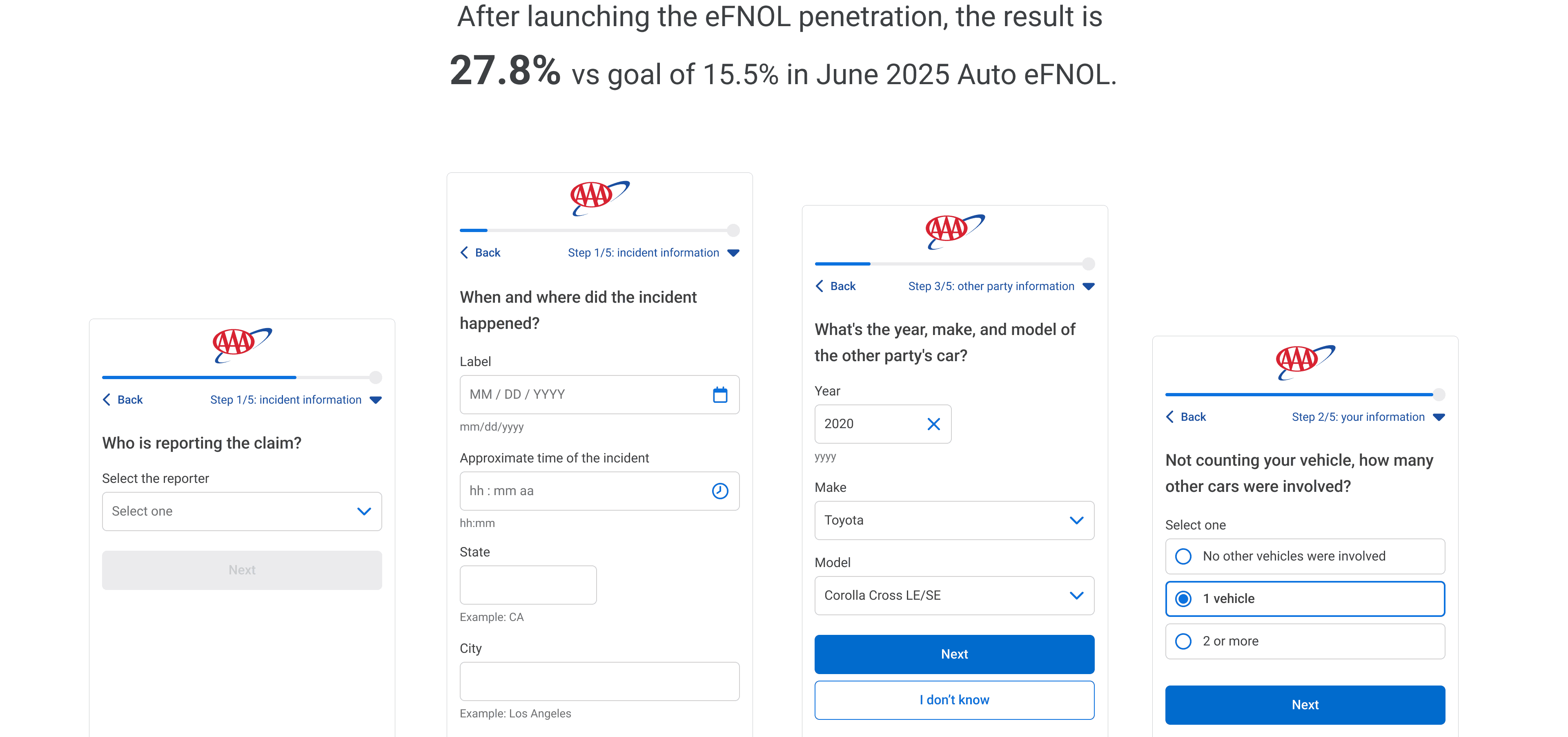

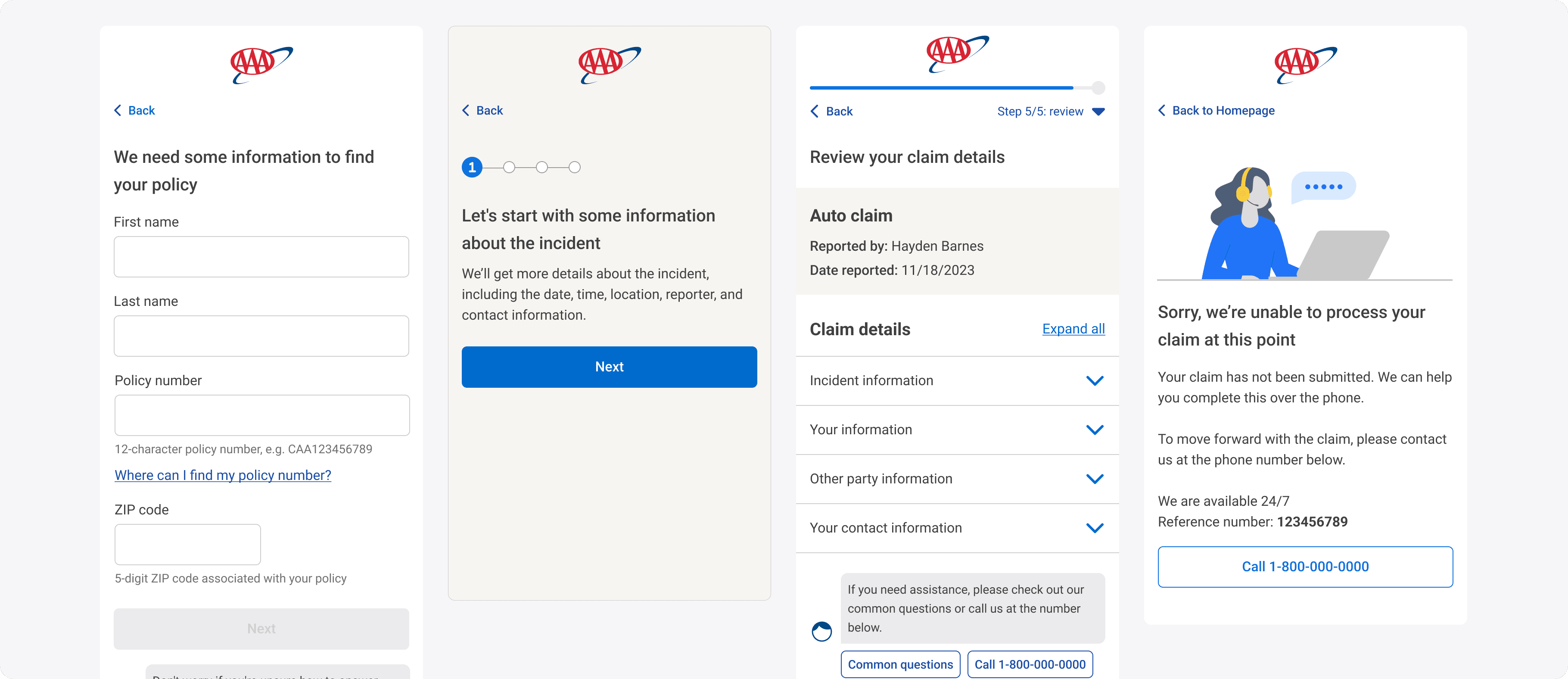

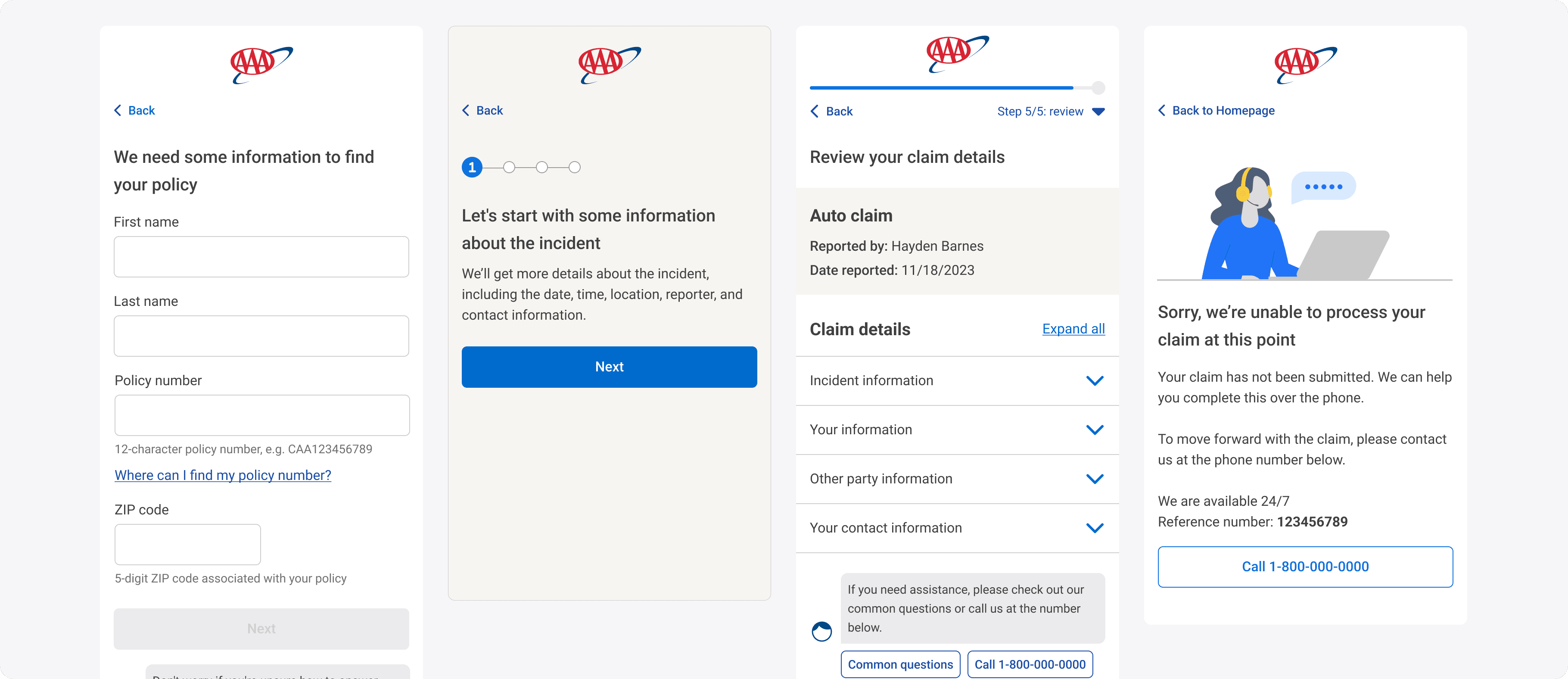

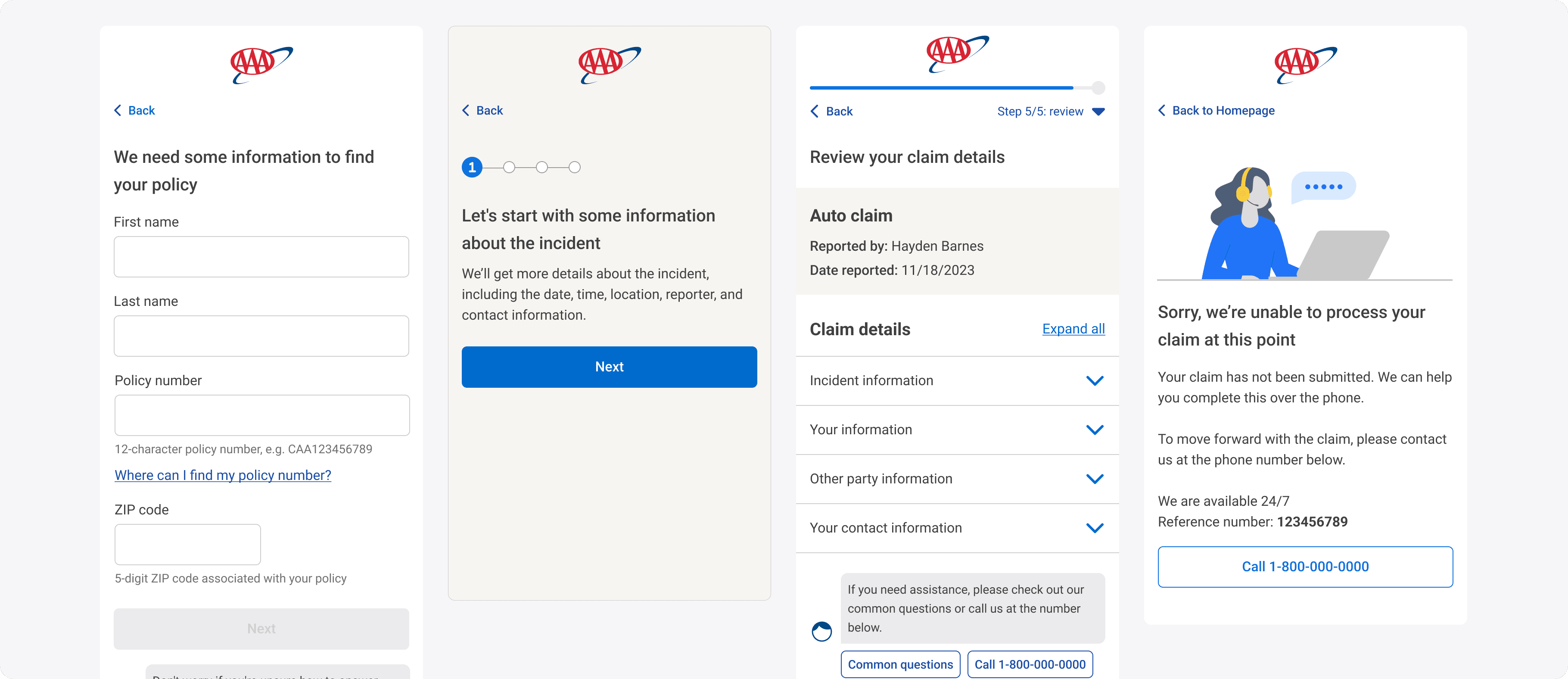

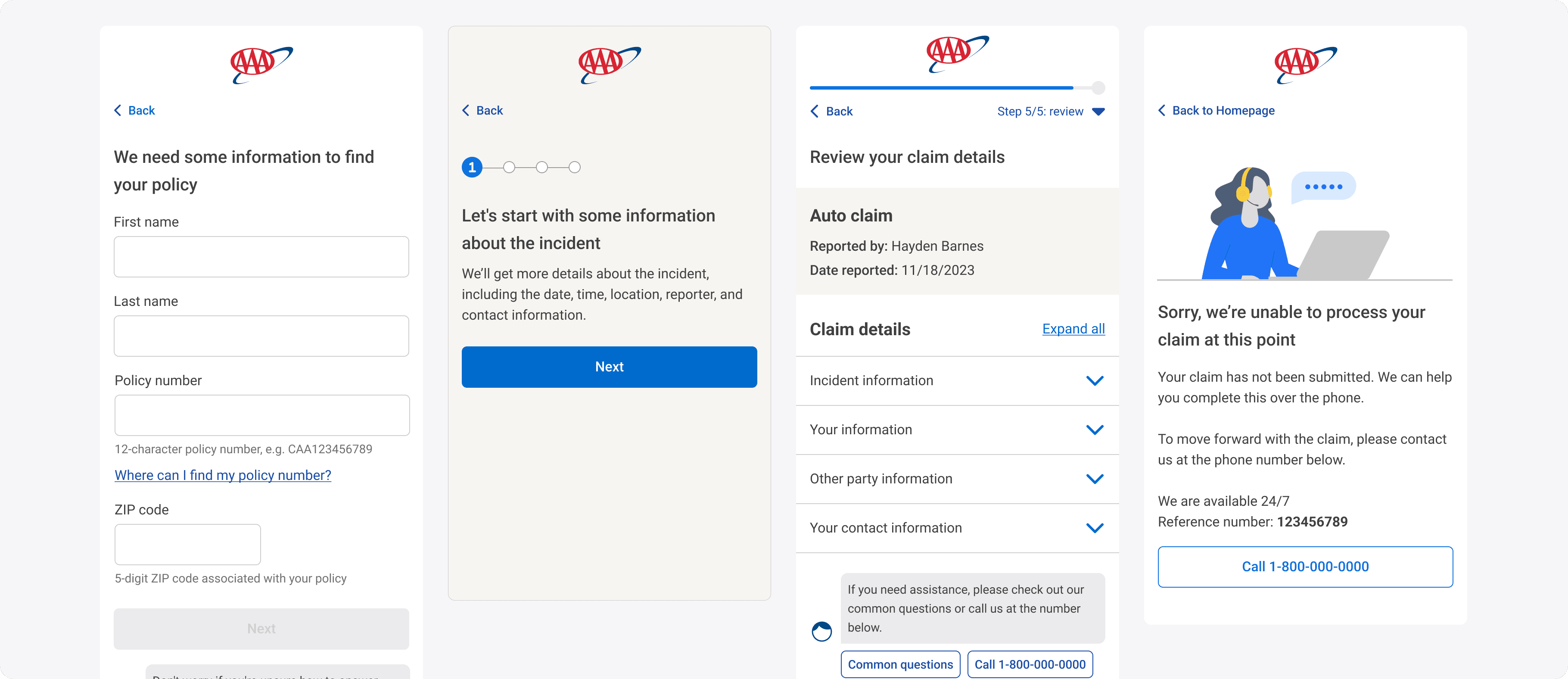

eFNOL (Electronic First Notice of Loss) allows users to submit an accident claim online through mobile or web, instead of calling an agent. Previously, this flow was only available to members with an AAA.com account, requiring them to log in before filing a claim.

eFNOL (Electronic First Notice of Loss) allows users to submit an accident claim online through mobile or web, instead of calling an agent. Previously, this flow was only available to members with an AAA.com account, requiring them to log in before filing a claim.

eFNOL (Electronic First Notice of Loss) allows users to submit an accident claim online through mobile or web, instead of calling an agent. Previously, this flow was only available to members with an AAA.com account, requiring them to log in before filing a claim.

eFNOL (Electronic First Notice of Loss) allows users to submit an accident claim online through mobile or web, instead of calling an agent. Previously, this flow was only available to members with an AAA.com account, requiring them to log in before filing a claim.

2024

2024

2024

Year

Year

Year

2024 - Q2,Q3

2024 - Q2,Q3

2024 - Q2,Q3

Duration

Duration

Duration

Self Service

Self Service

Team

Team

Team

UX/UI Designer

UX/UI Designer

UX/UI Designer

Role

Role

Role

1year 7months

Duration

Chrome OS

Team

Visual Designer

Role

Visual Designer, Developer, and Motion Designer

Collaborate with

Visual Designer, Developer, and Motion Designer

Visual Designer, Developer, and Motion Designer

Visual Designer, Developer, and Motion Designer

Collaborate with

Collaborate with

Collaborate with

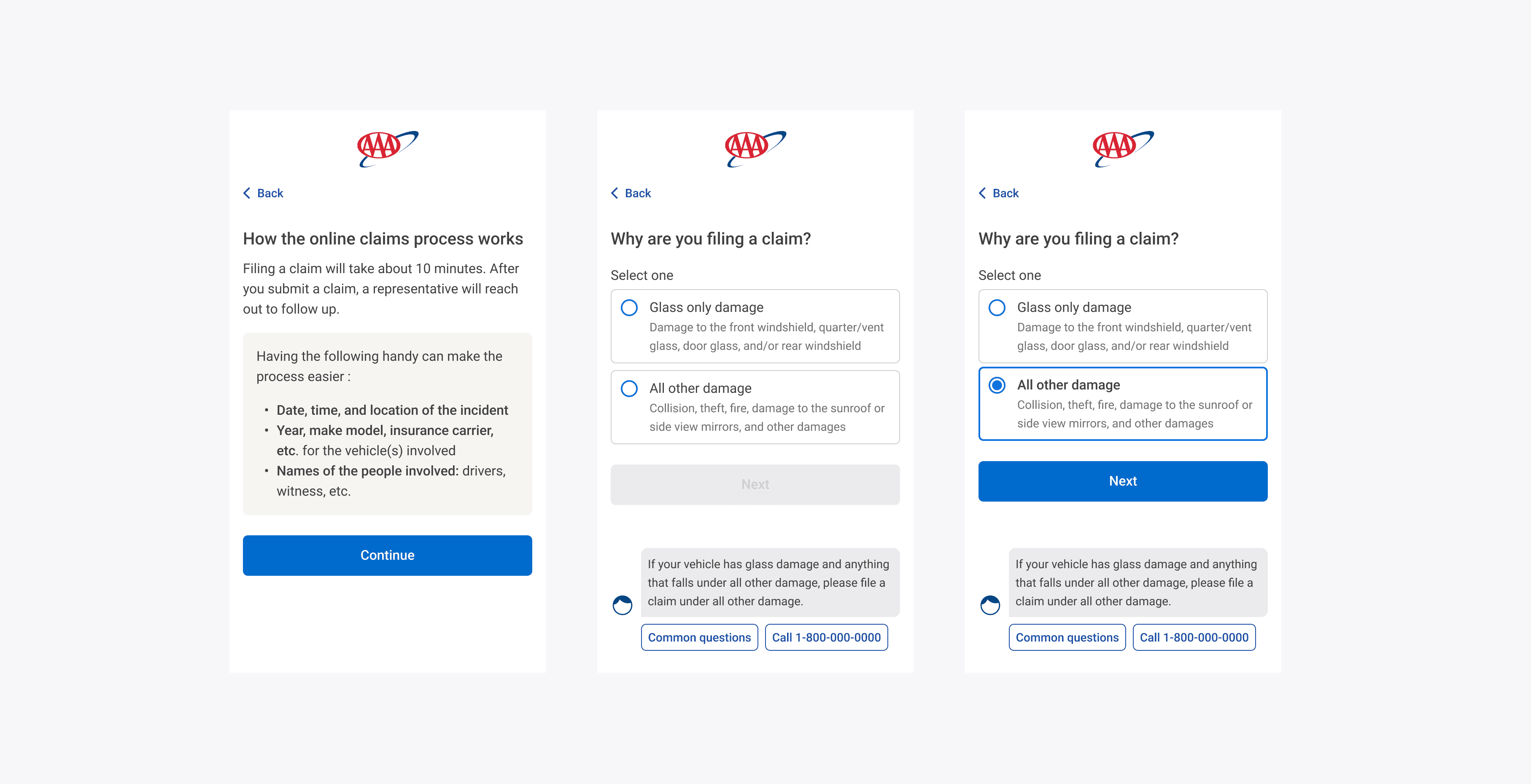

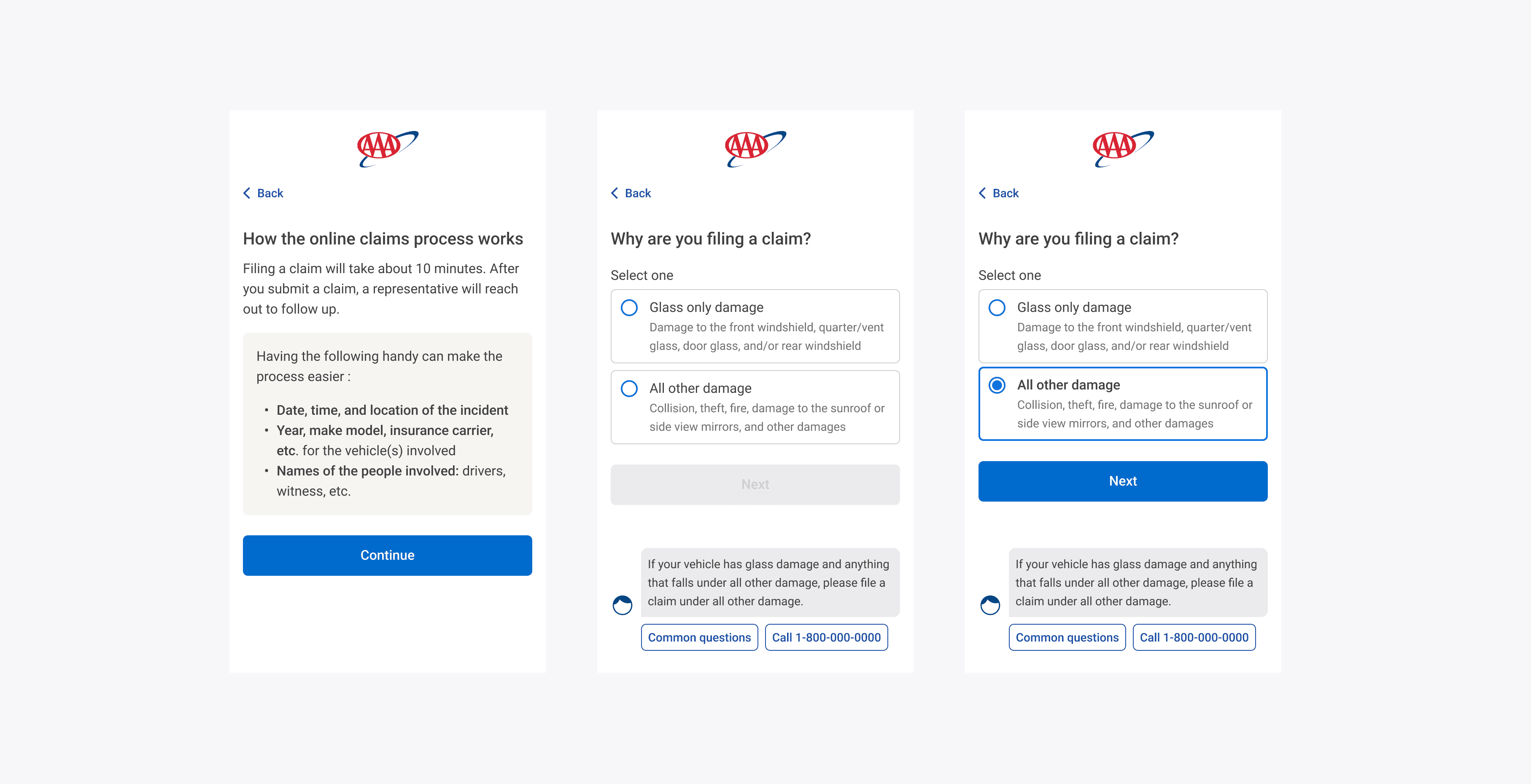

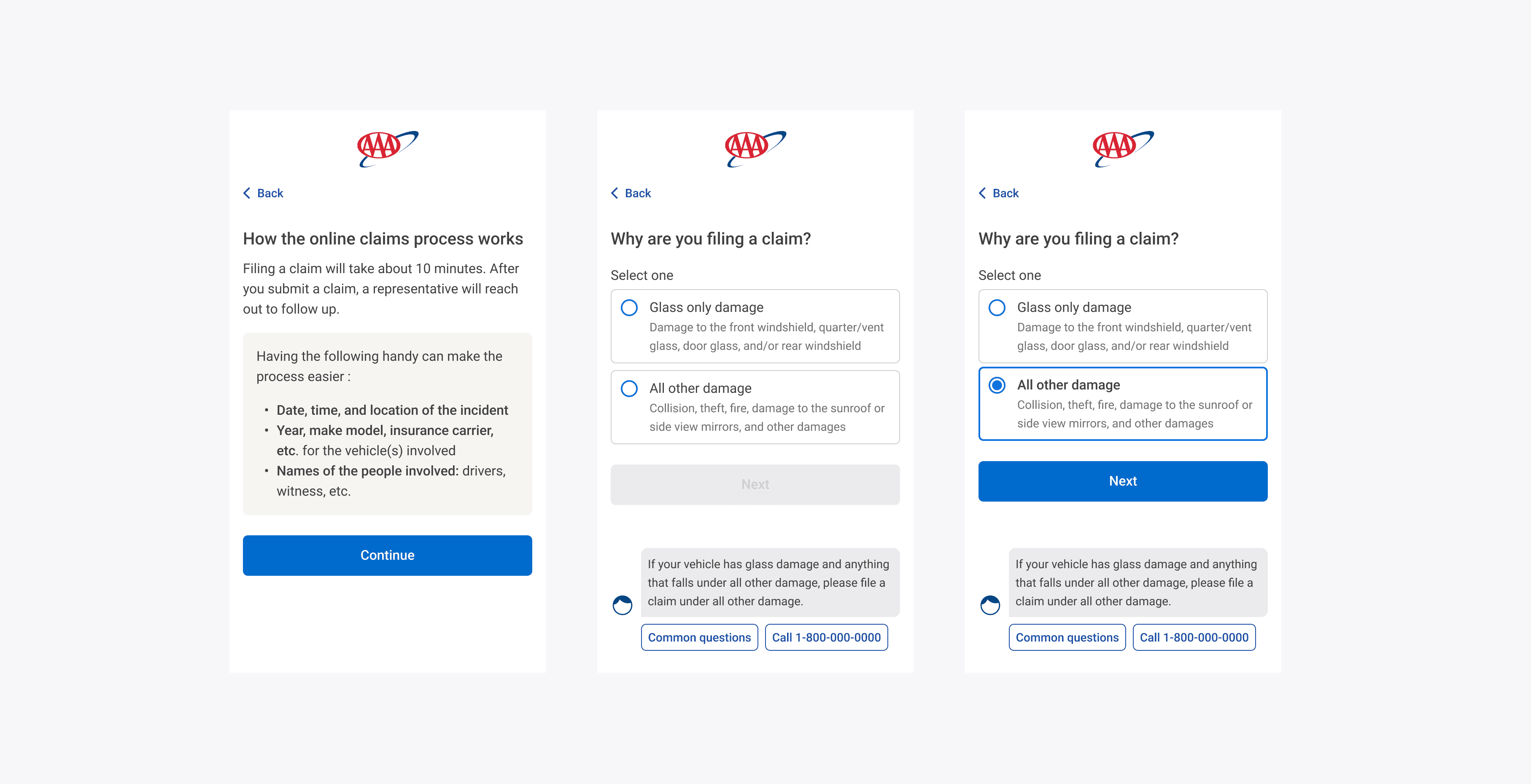

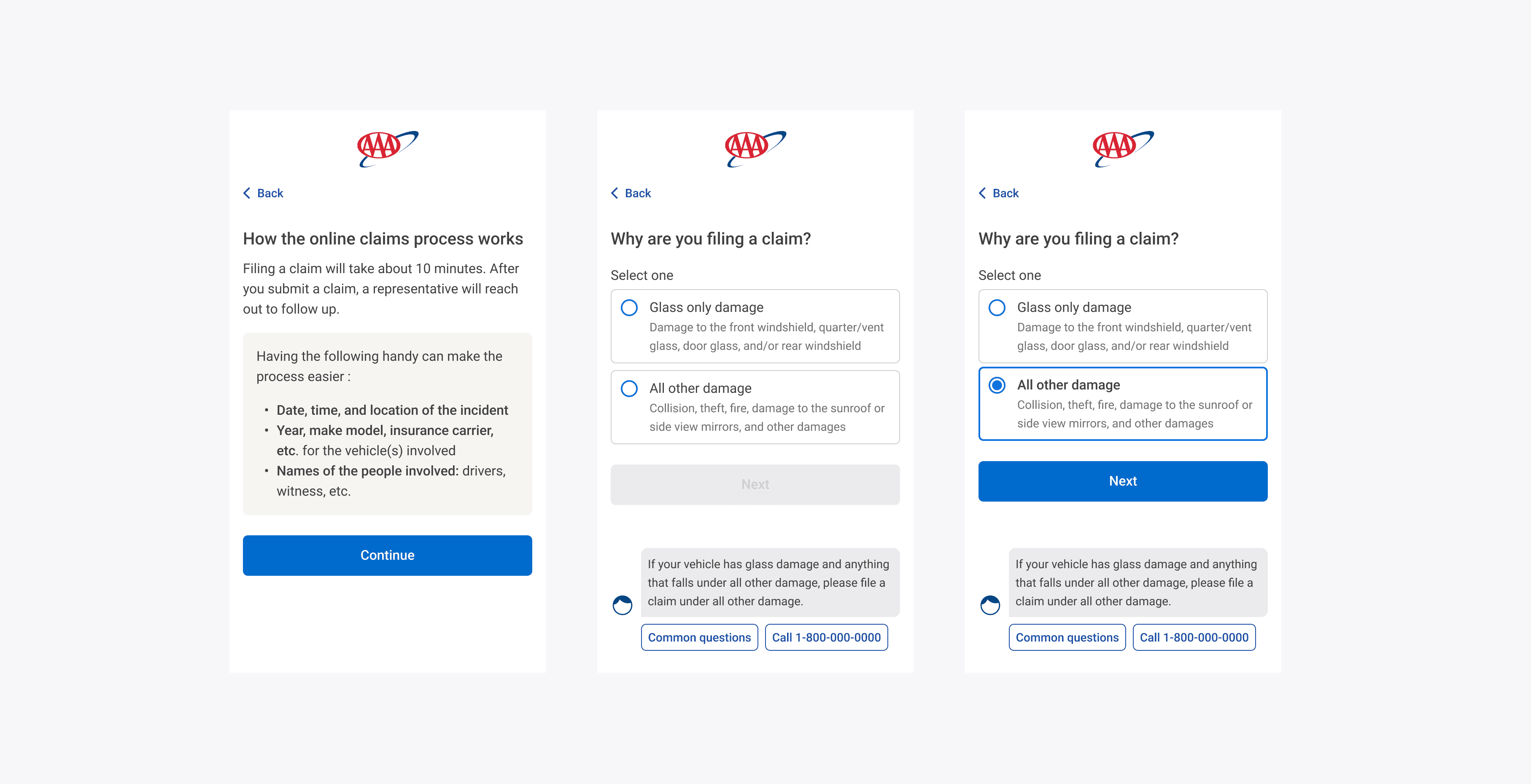

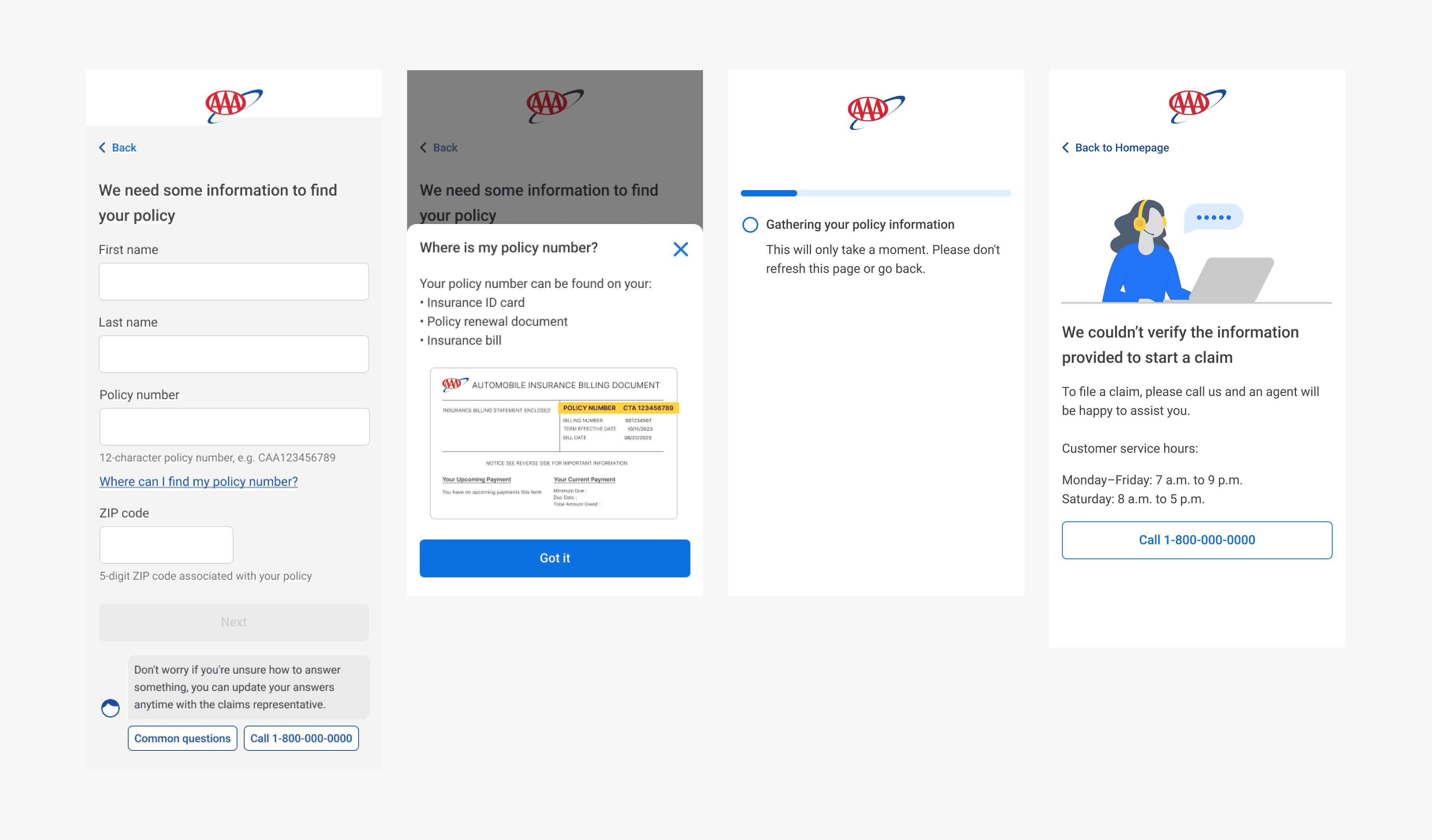

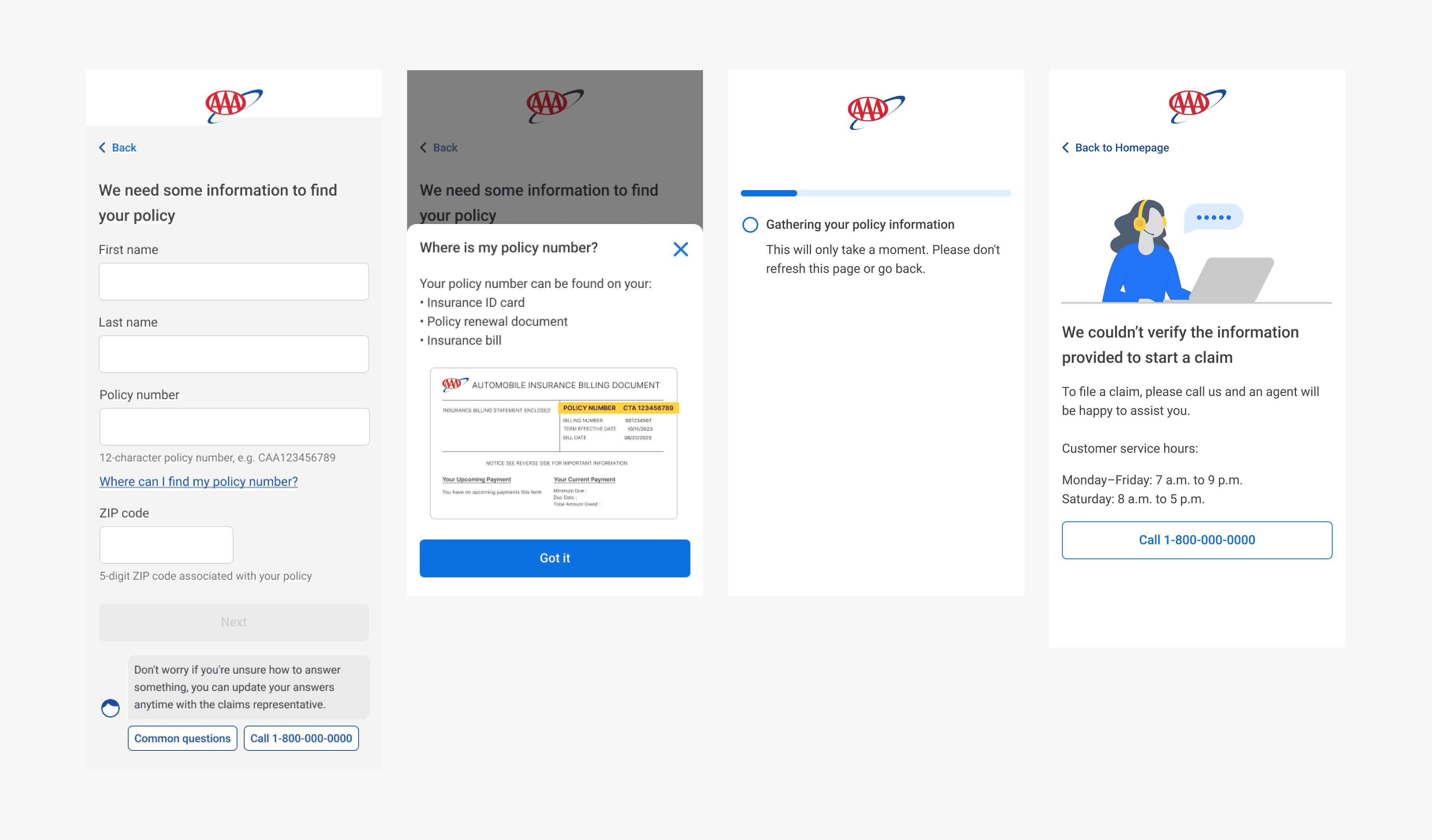

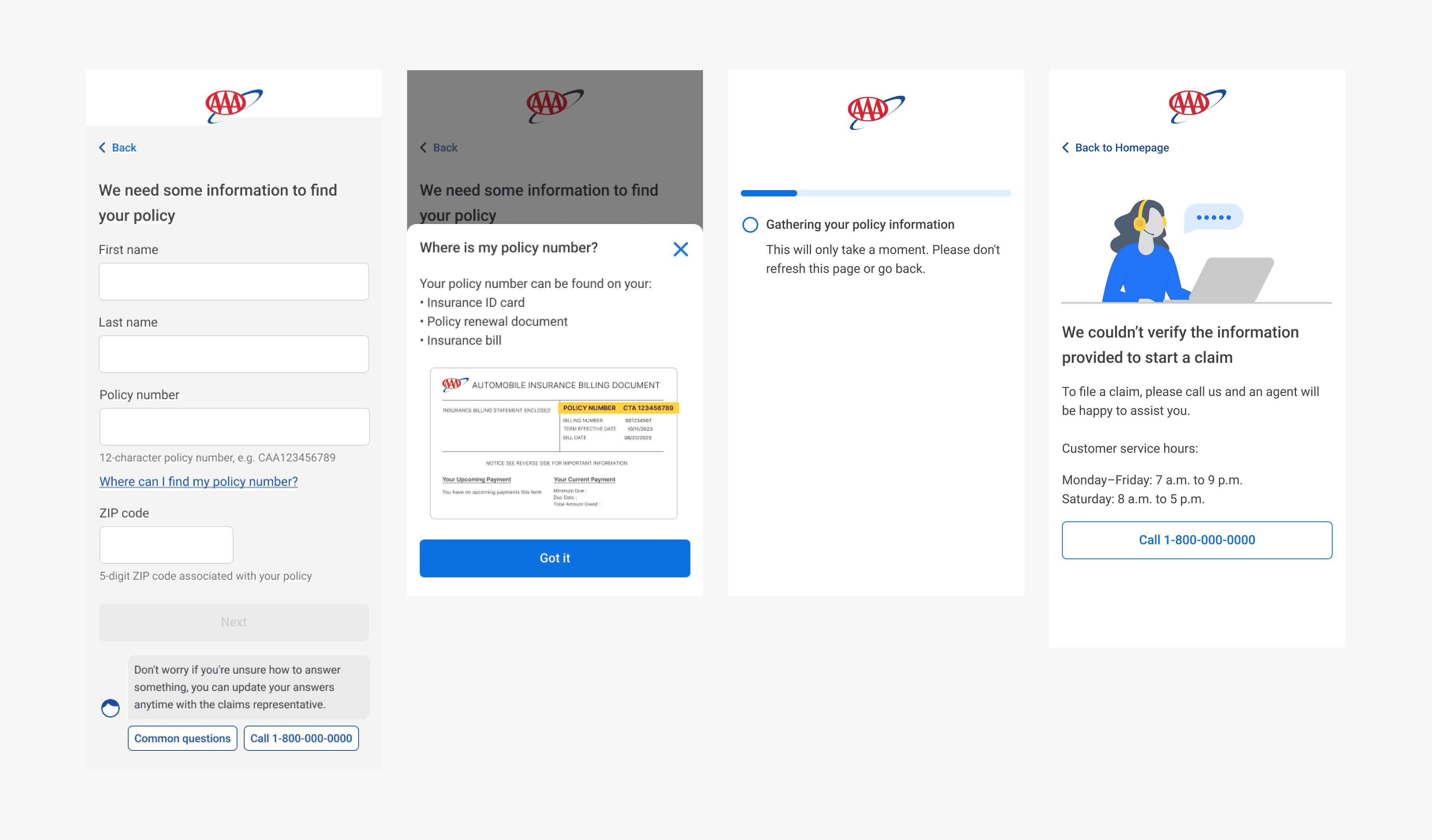

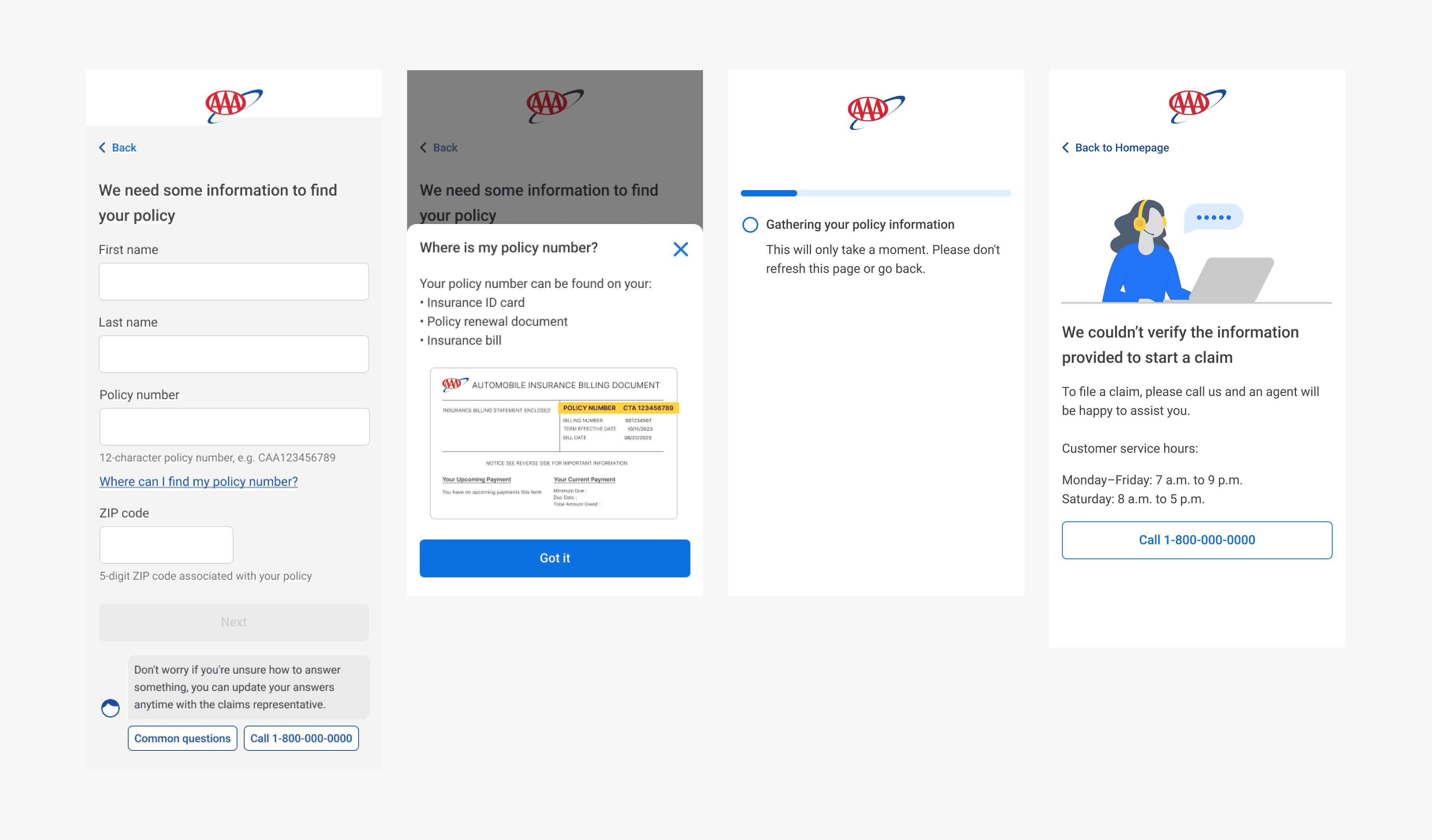

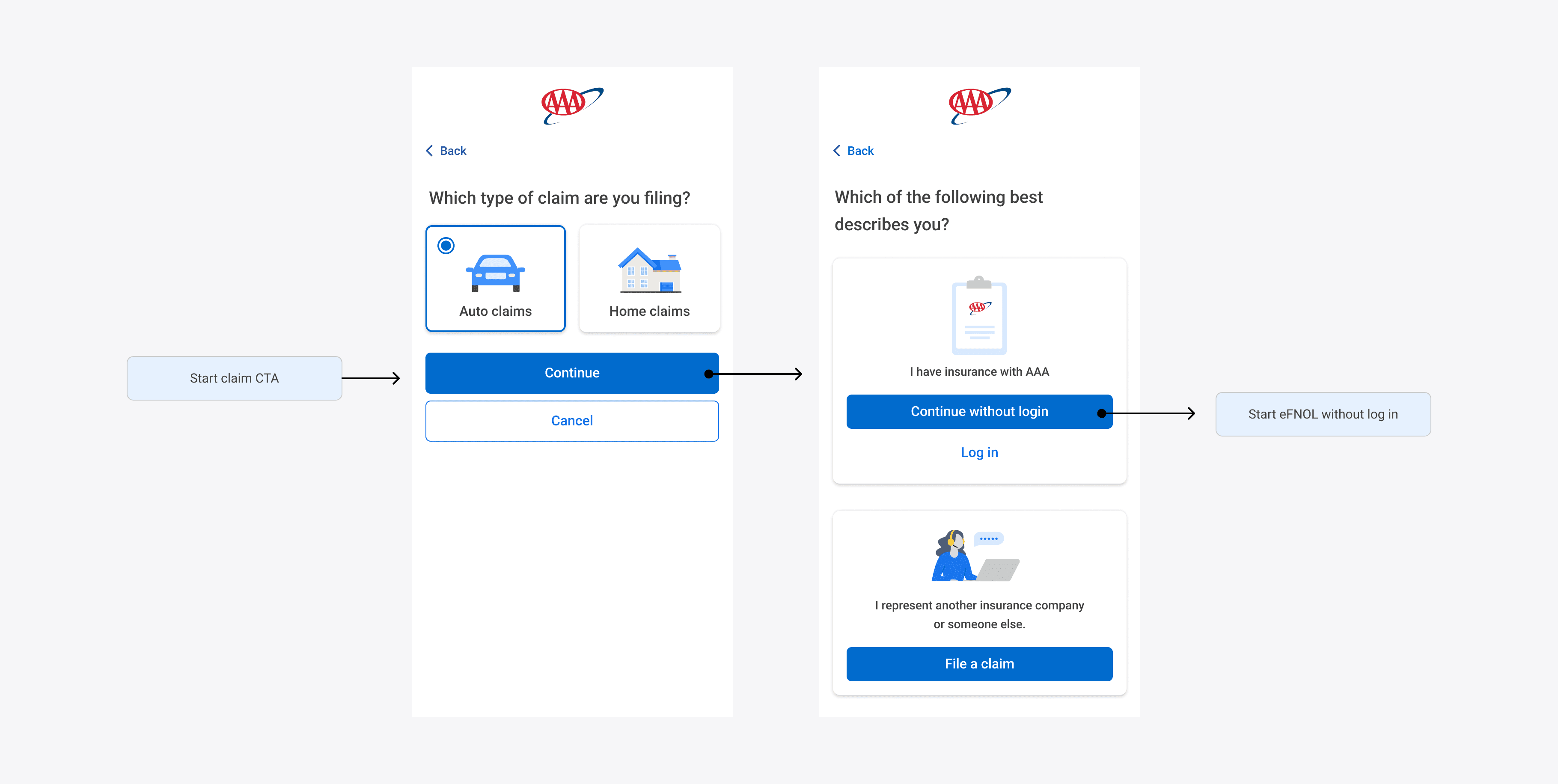

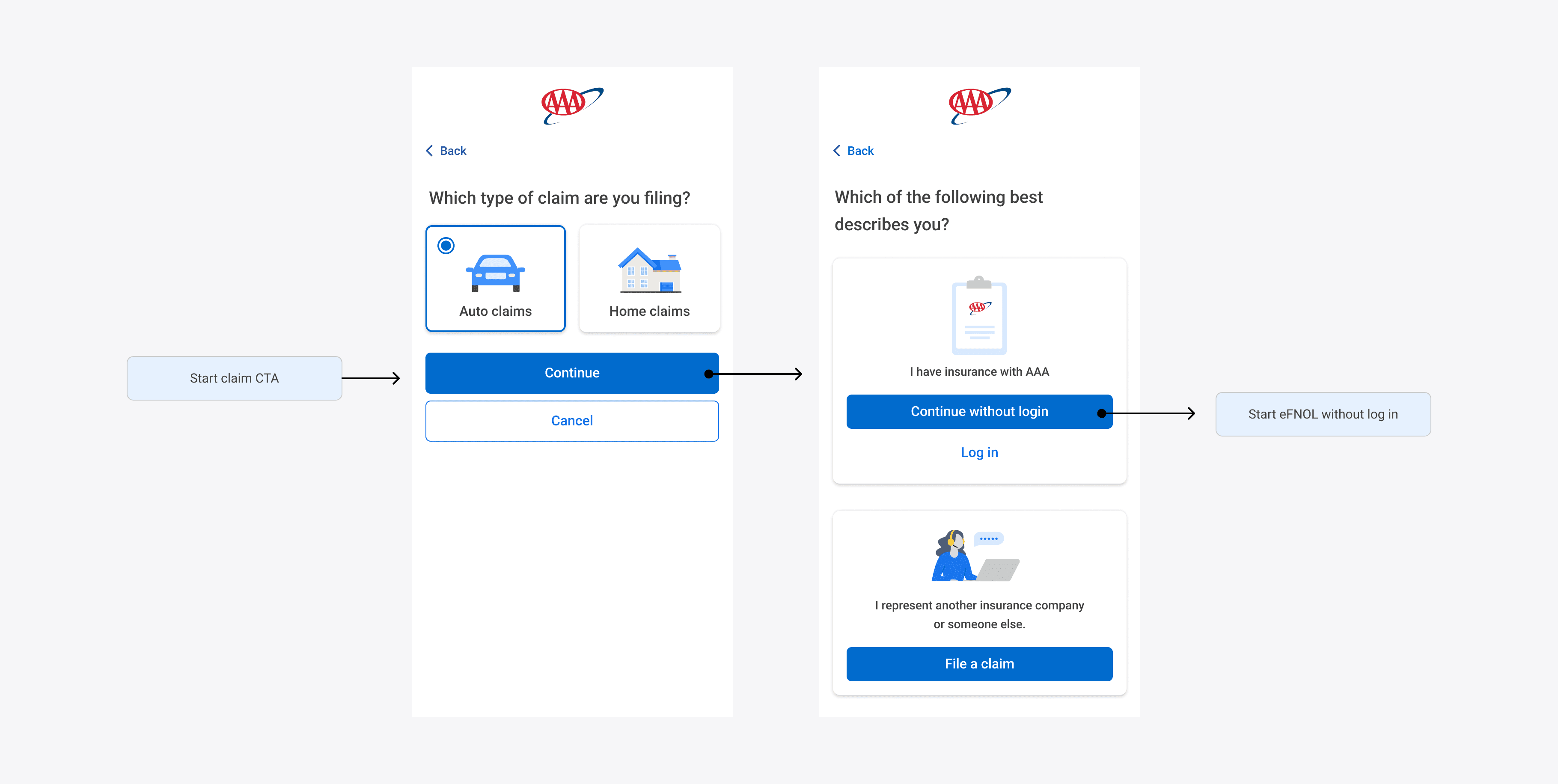

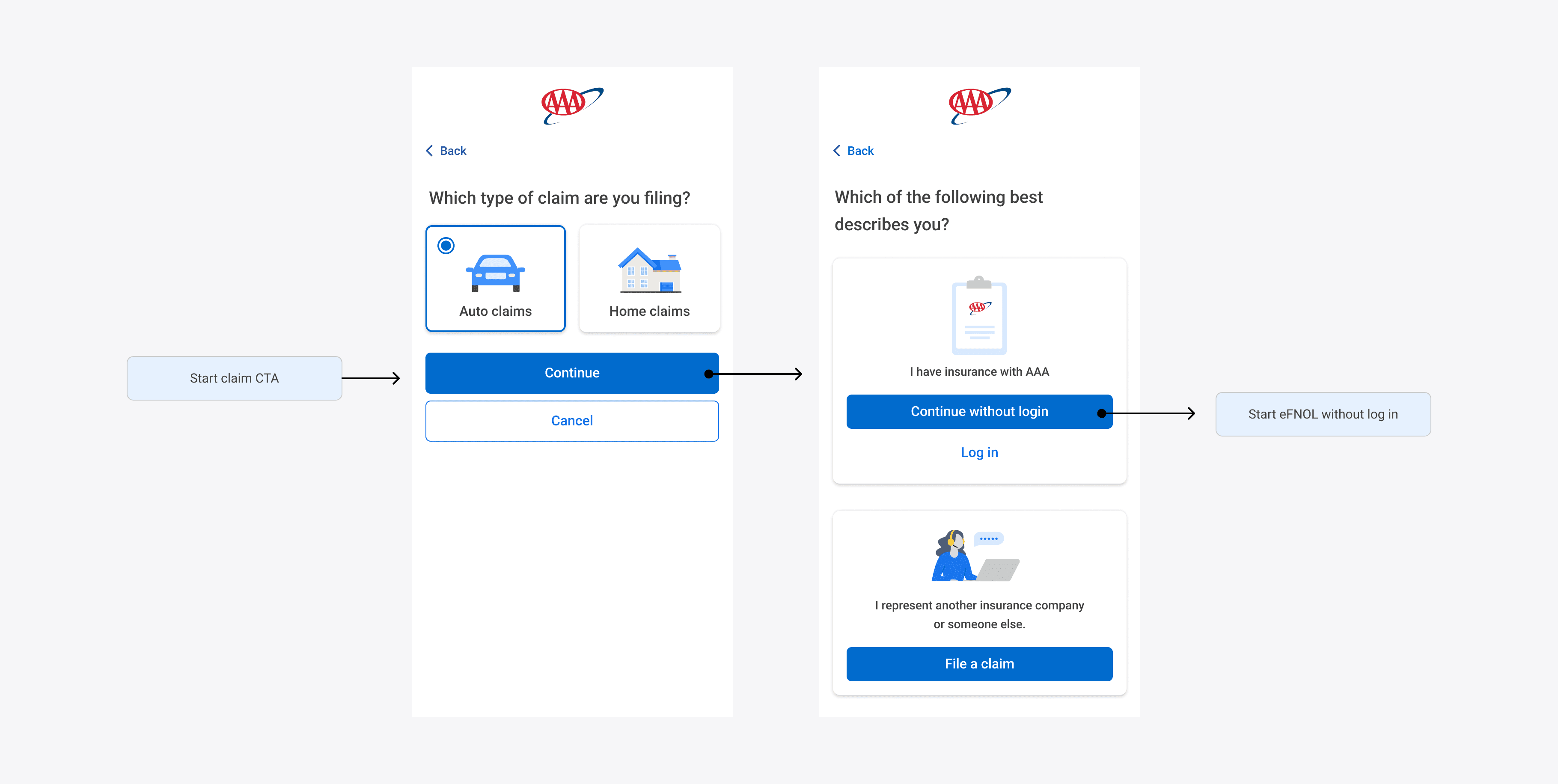

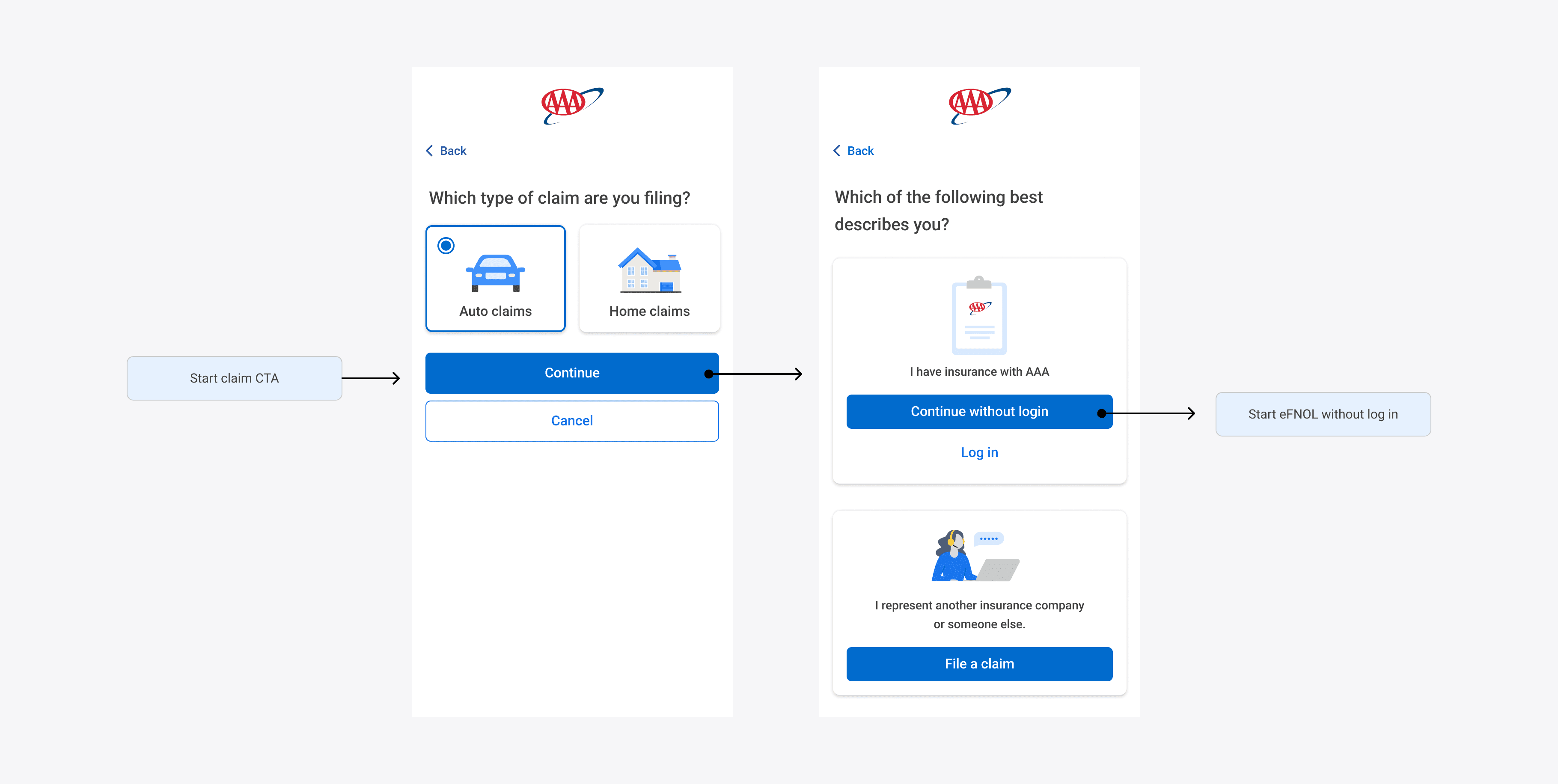

This project introduced a new without-login flow, enabling users to start a claim without an account. Instead of logging in, customers can enter their policy number and basic personal information to proceed. This makes the claims process more accessible, especially for users who don’t have an account or can’t log in at the time of the accident. In addition to designing this new flow, I also updated the experience with 3.0 visual design standards—applying the latest components, creating new ones where needed, and ensuring consistency across the product.

This project introduced a new without-login flow, enabling users to start a claim without an account. Instead of logging in, customers can enter their policy number and basic personal information to proceed. This makes the claims process more accessible, especially for users who don’t have an account or can’t log in at the time of the accident. In addition to designing this new flow, I also updated the experience with 3.0 visual design standards—applying the latest components, creating new ones where needed, and ensuring consistency across the product.

Defined the current problem

Defined the current problem

Currently, we have an existing eFNOL flow that requries users to log in their AAA.com account. This feature has caused two main problem:

First, users who don’t have a AAA.com account must create one before submitting a claim. This leads to a high drop-off rate, increases call volume to agents, and forces users to spend time creating an account in urgent situations.

Second, the high number of calls not only includes claim submissions but also follow-ups and status inquiries. This creates overwhelming call volumes for agents, causing delays in processing claims and reducing overall customer satisfaction.

Currently, we have an existing eFNOL flow that requries users to log in their AAA.com account. This feature has caused two main problem:

First, users who don’t have a AAA.com account must create one before submitting a claim. This leads to a high drop-off rate, increases call volume to agents, and forces users to spend time creating an account in urgent situations.

Second, the high number of calls not only includes claim submissions but also follow-ups and status inquiries. This creates overwhelming call volumes for agents, causing delays in processing claims and reducing overall customer satisfaction.

Currently, we have an existing eFNOL flow that requries users to log in their AAA.com account. This feature has caused two main problem:

First, users who don’t have a AAA.com account must create one before submitting a claim. This leads to a high drop-off rate, increases call volume to agents, and forces users to spend time creating an account in urgent situations.

Second, the high number of calls not only includes claim submissions but also follow-ups and status inquiries. This creates overwhelming call volumes for agents, causing delays in processing claims and reducing overall customer satisfaction.

Currently, we have an existing eFNOL flow that requries users to log in their AAA.com account. This feature has caused two main problem:

First, users who don’t have a AAA.com account must create one before submitting a claim. This leads to a high drop-off rate, increases call volume to agents, and forces users to spend time creating an account in urgent situations.

Second, the high number of calls not only includes claim submissions but also follow-ups and status inquiries. This creates overwhelming call volumes for agents, causing delays in processing claims and reducing overall customer satisfaction.

Product Vision:

Offer insured users a seamless, user-friendly online claims experience that simplifies and accelerates the claims process.

UX goal:

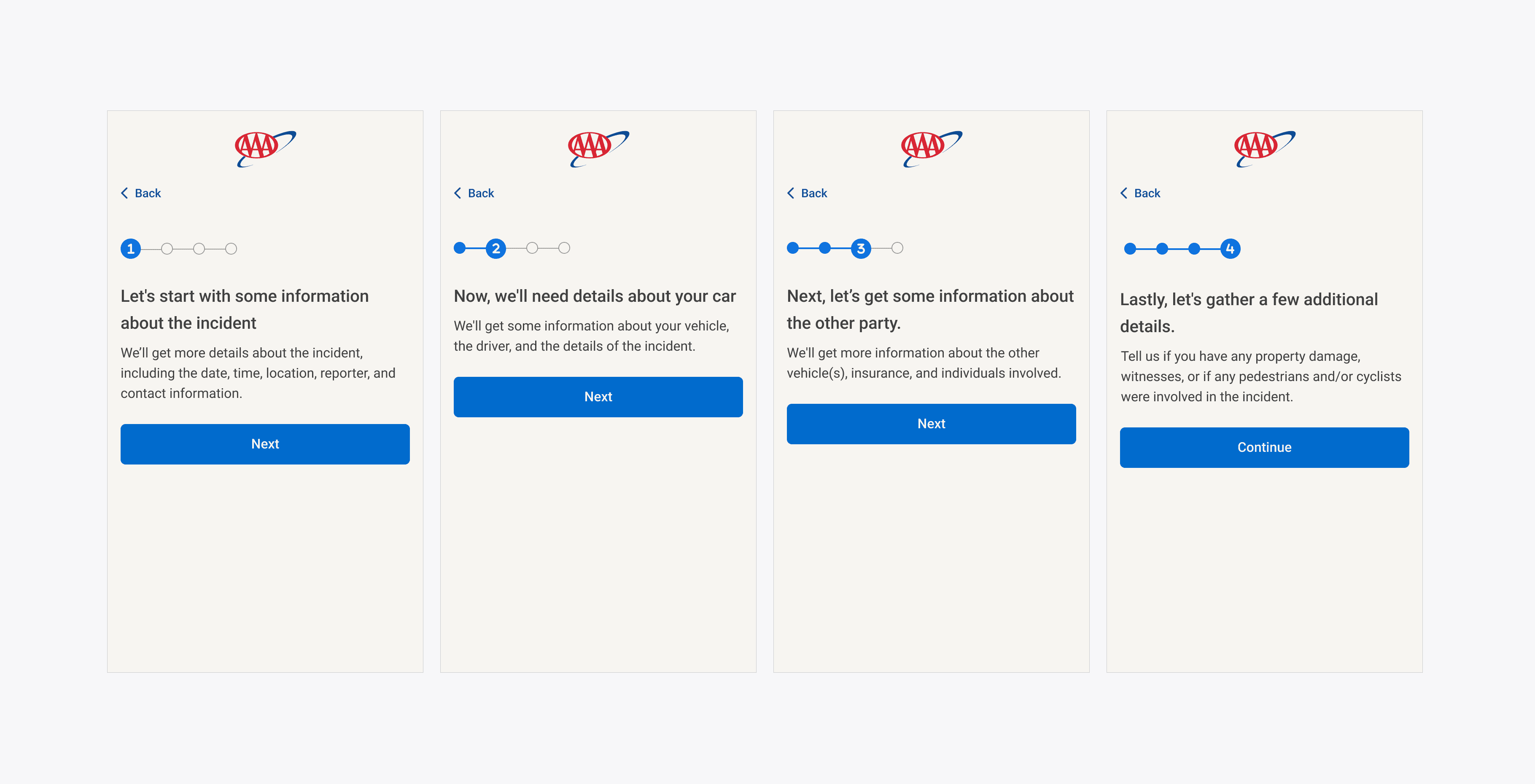

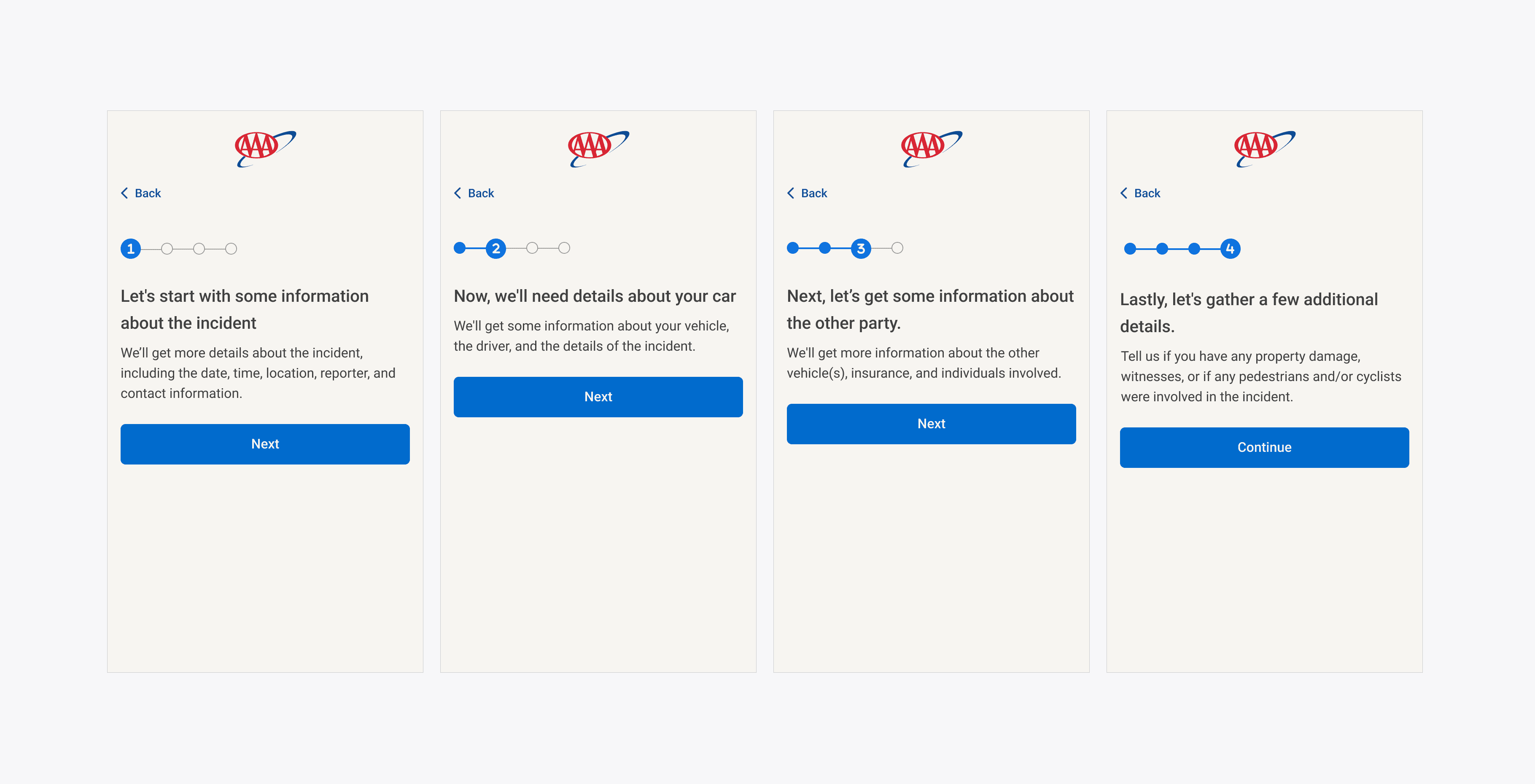

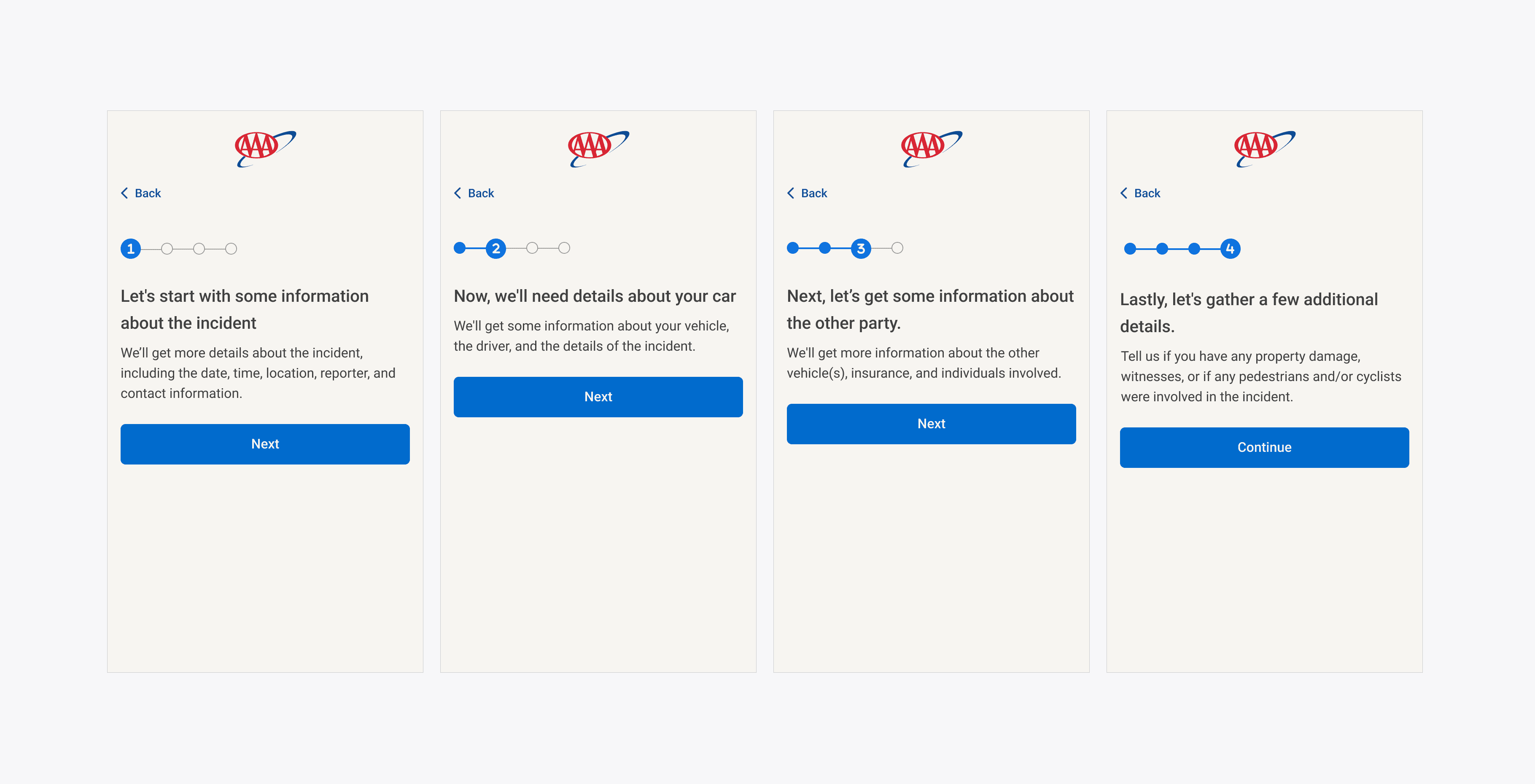

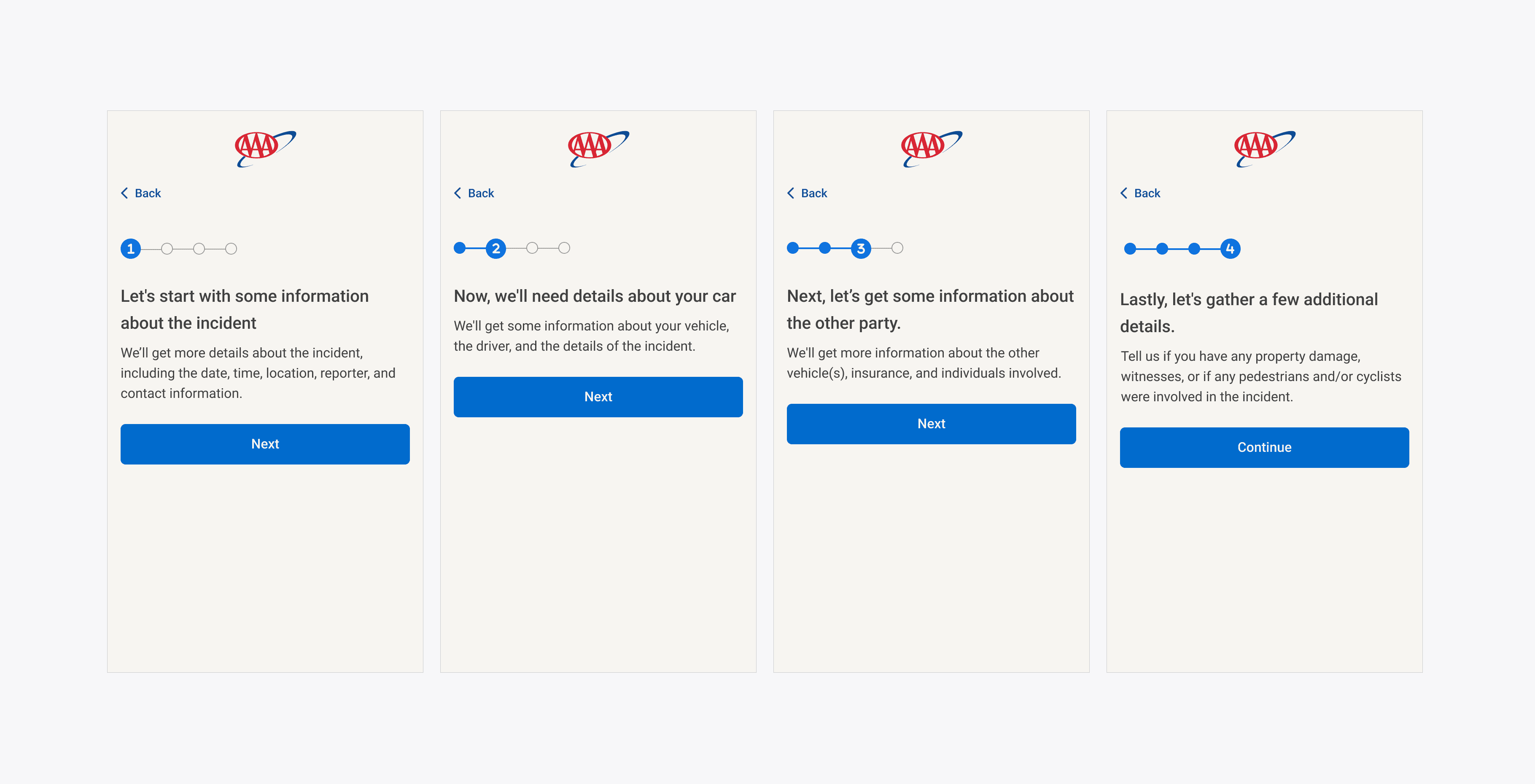

Use plain, user-friendly language to explain each step clearly.

Design a simplified flow to make claims easier to complete.

Introduce a progress bar to help users understand their current progress and what comes next.

Provide clear and accessible information online, reducing the need for customers to call unless they face an issue.

Gather as much initial information as possible so agents don’t need to repeat questions during follow-up.

Identify opportunities to reduce the number of screens, preventing users from feeling overwhelmed by a long flow.

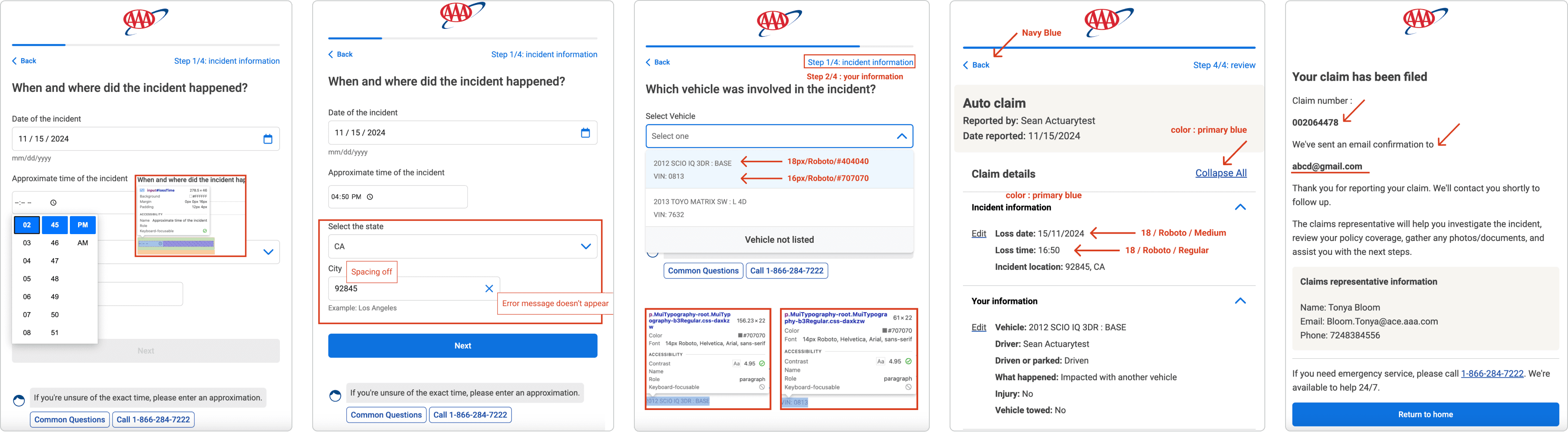

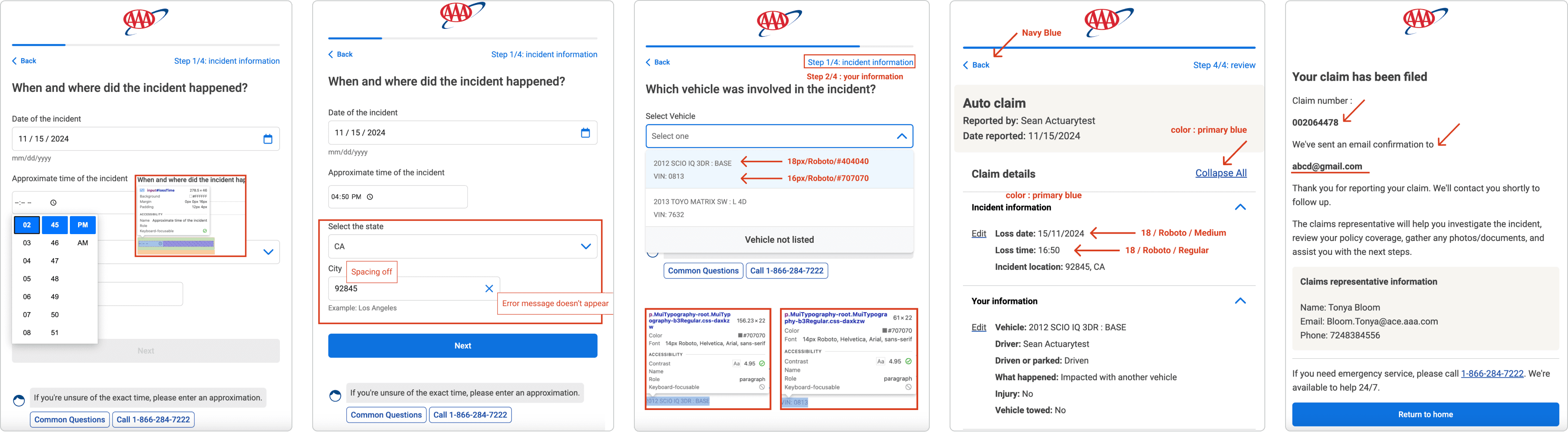

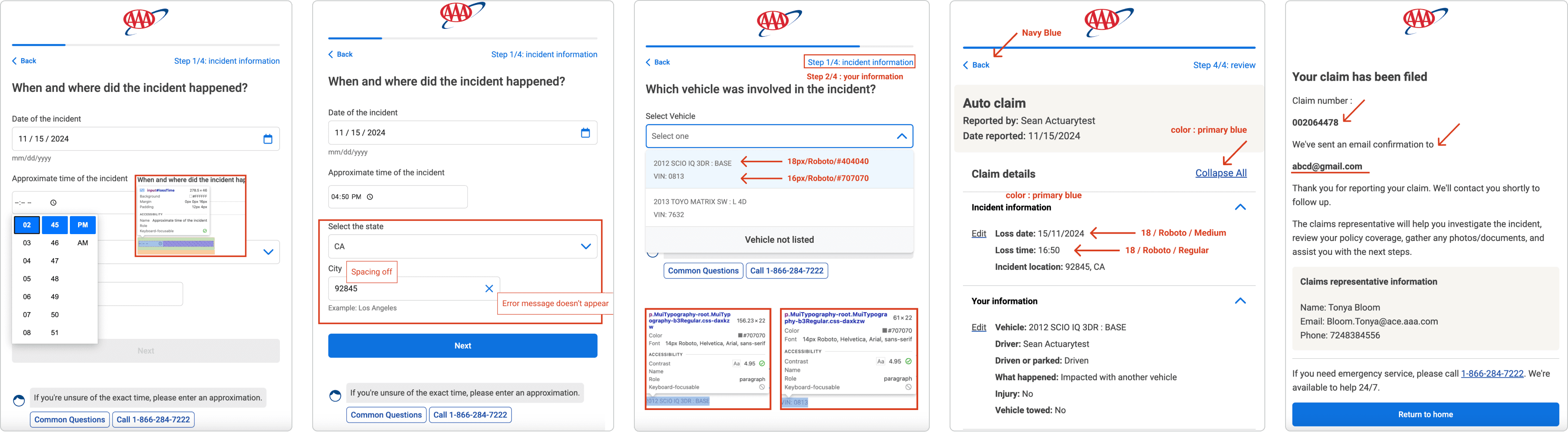

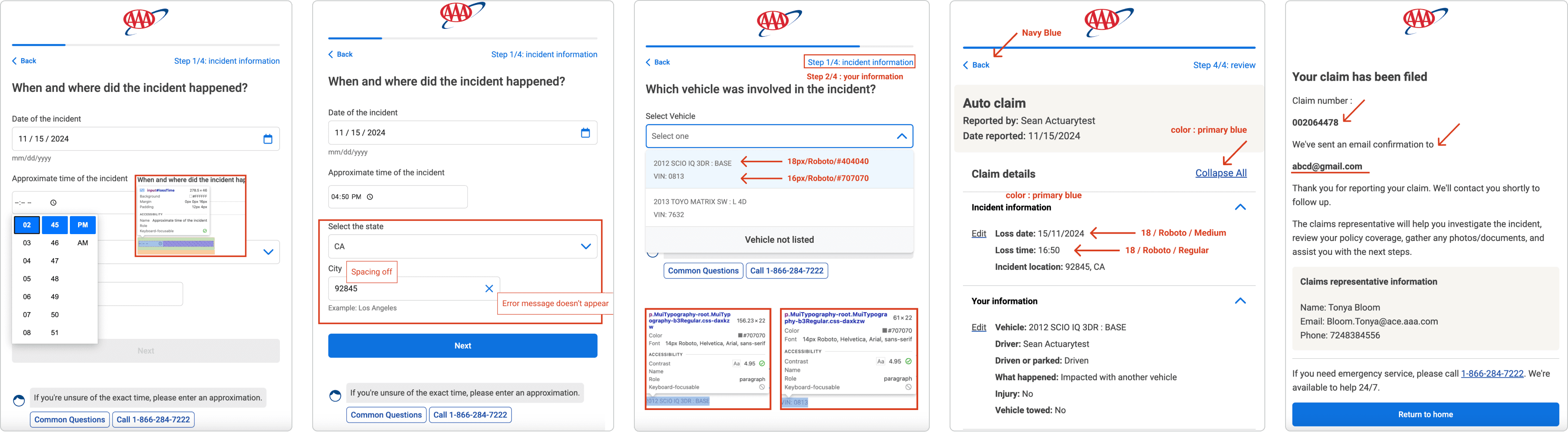

Goal: Created a user friendly time picker component with simple interactions for easily inputting hours, minutes, and AM/PM, allowing users of all age group of enter time as needed.

Product Vision:

Offer insured users a seamless, user-friendly online claims experience that simplifies and accelerates the claims process.

UX goal:

Use plain, user-friendly language to explain each step clearly.

Design a simplified flow to make claims easier to complete.

Introduce a progress bar to help users understand their current progress and what comes next.

Provide clear and accessible information online, reducing the need for customers to call unless they face an issue.

Gather as much initial information as possible so agents don’t need to repeat questions during follow-up.

Identify opportunities to reduce the number of screens, preventing users from feeling overwhelmed by a long flow.

Product Vision:

Offer insured users a seamless, user-friendly online claims experience that simplifies and accelerates the claims process.

UX goal:

Use plain, user-friendly language to explain each step clearly.

Design a simplified flow to make claims easier to complete.

Introduce a progress bar to help users understand their current progress and what comes next.

Provide clear and accessible information online, reducing the need for customers to call unless they face an issue.

Gather as much initial information as possible so agents don’t need to repeat questions during follow-up.

Identify opportunities to reduce the number of screens, preventing users from feeling overwhelmed by a long flow.

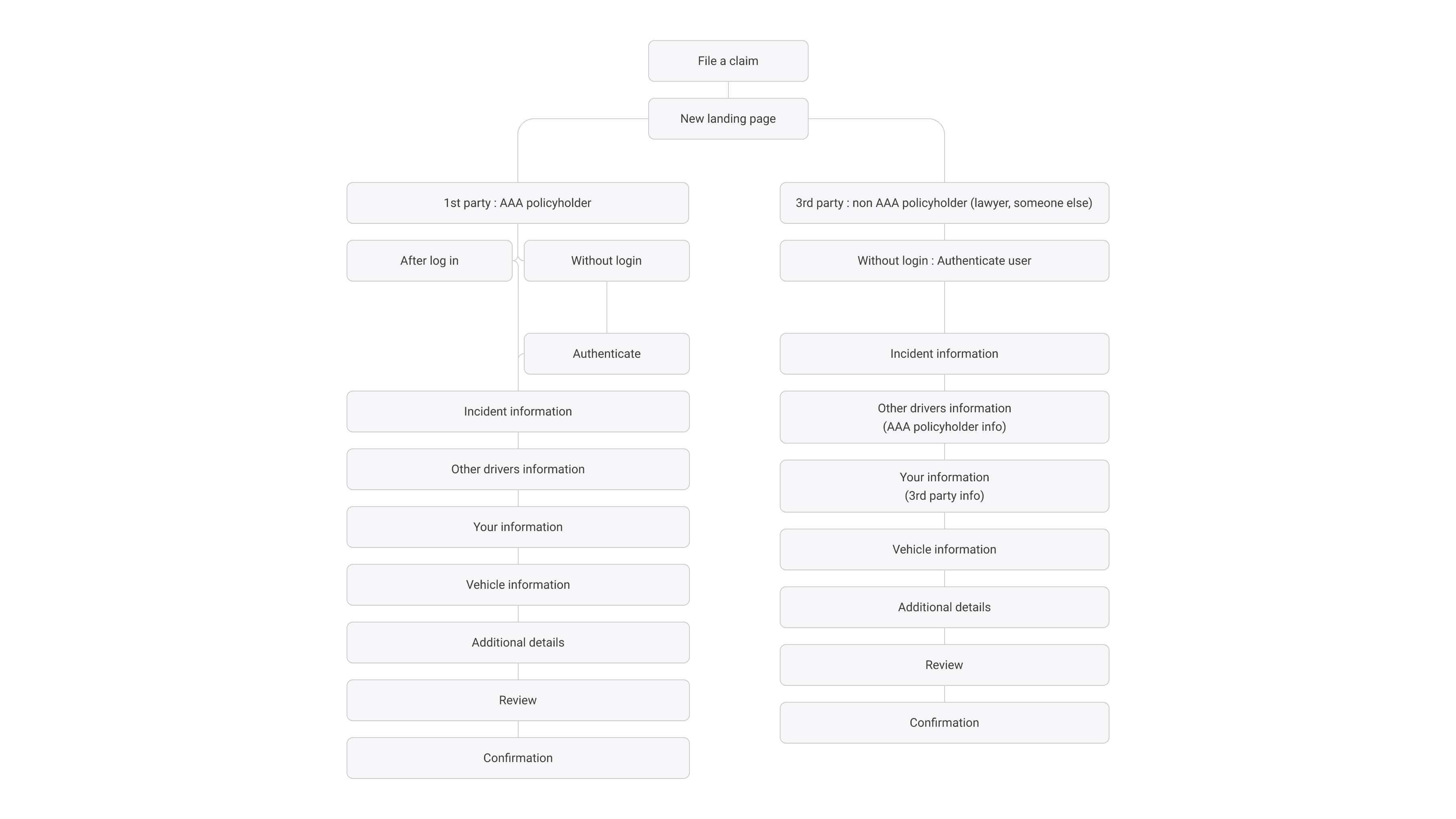

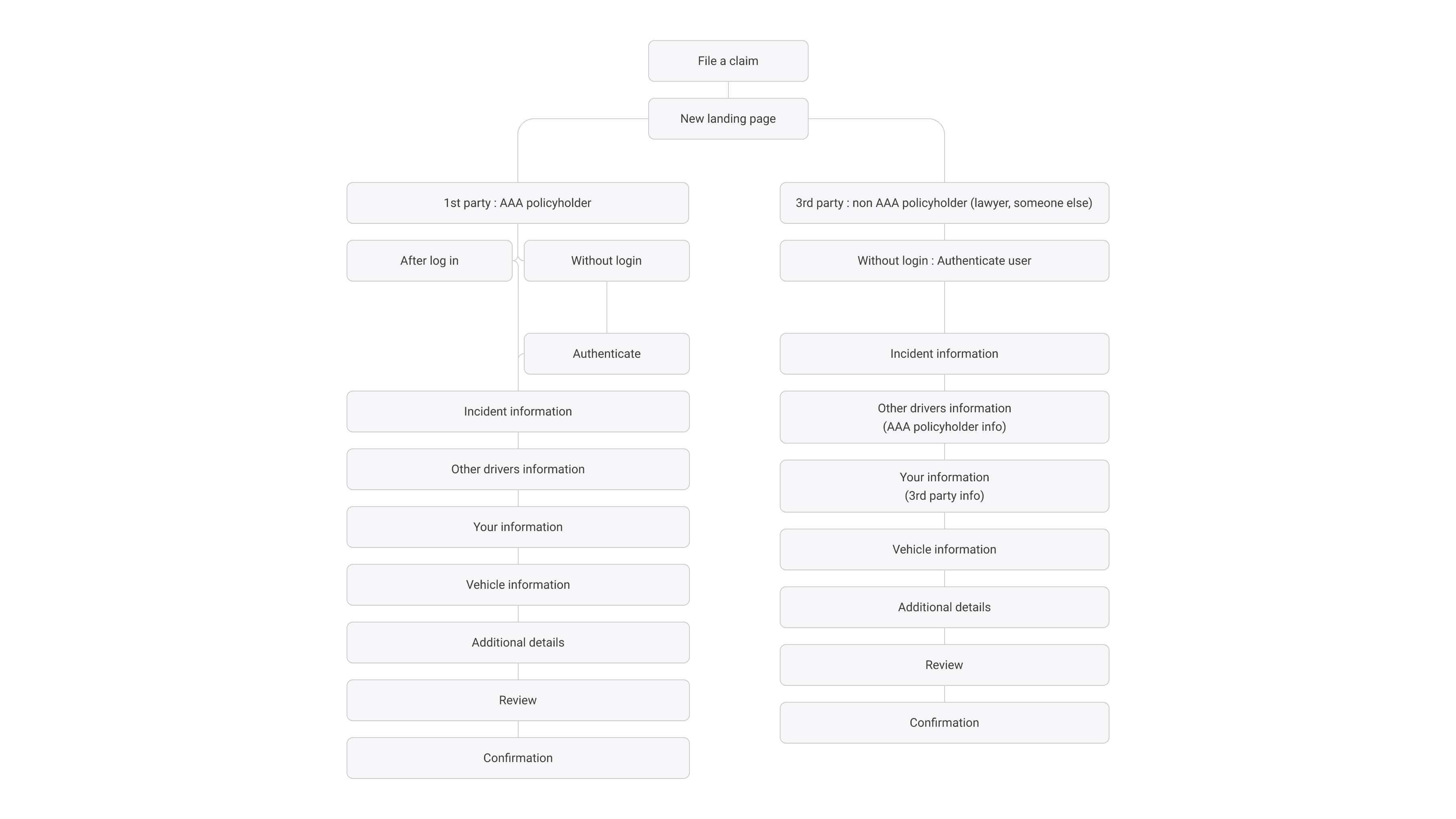

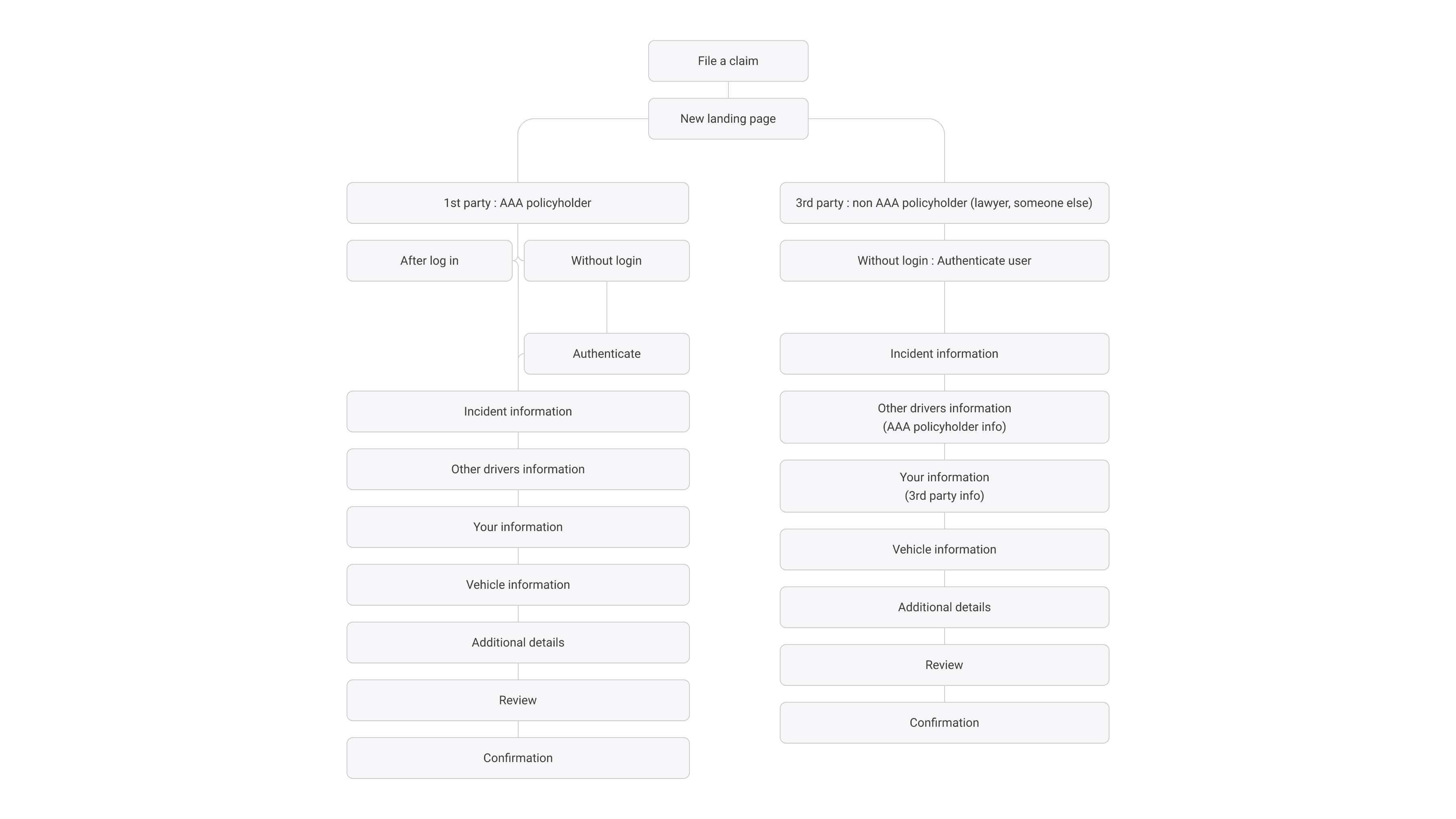

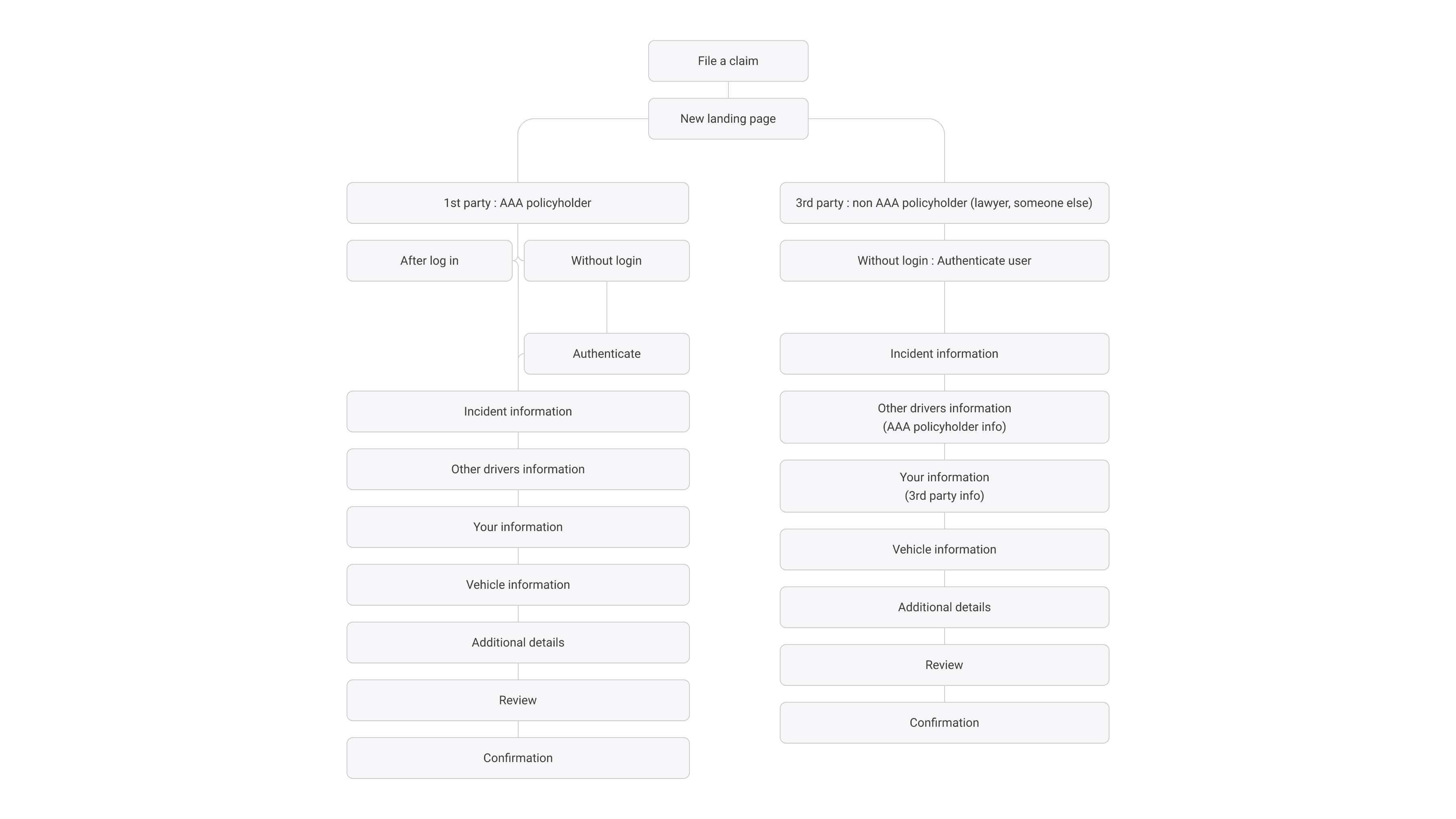

Set flow architecture

Set flow architecture

Set flow architecture

Set flow architecture

Entry flow

Entry flow

Entry flow

Authenticate flow

Authenticate flow

Transition page between the each category

Transition page between the each category

Transition page between the each category

QA Testing

QA Testing

QA Testing

QA Testing

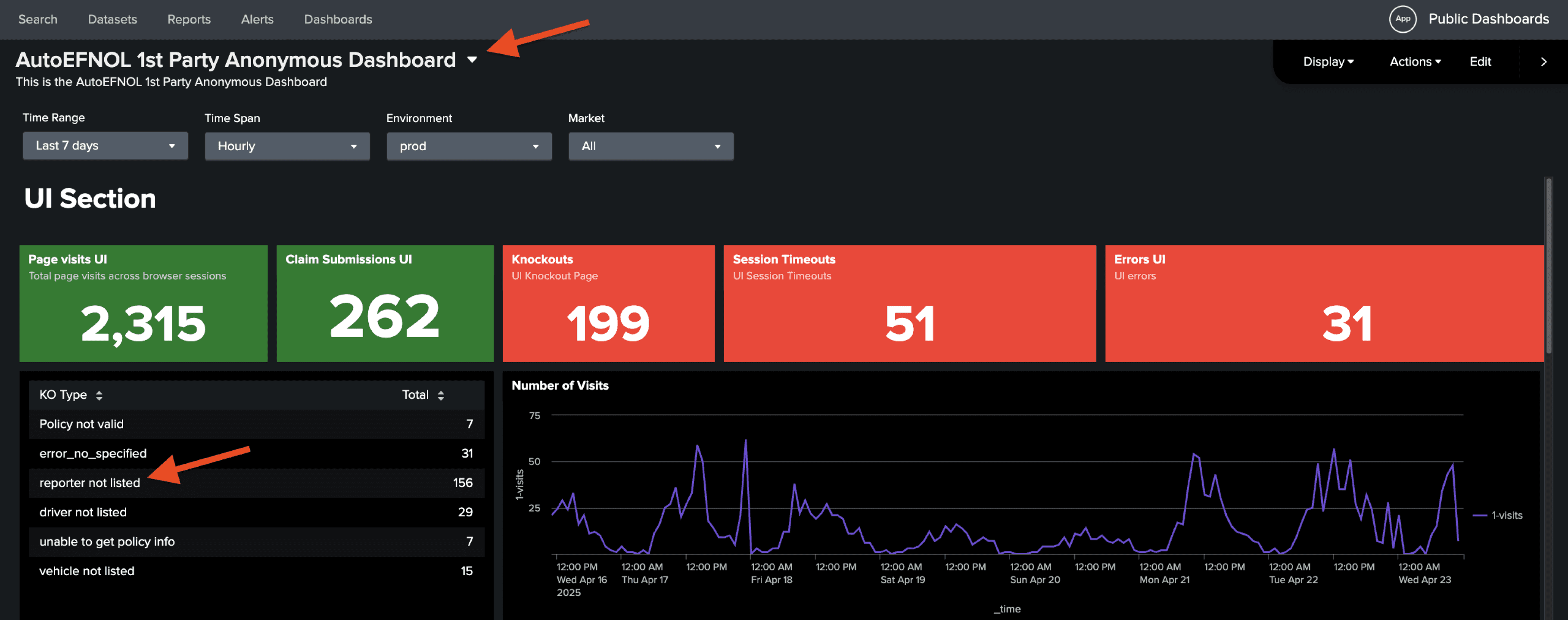

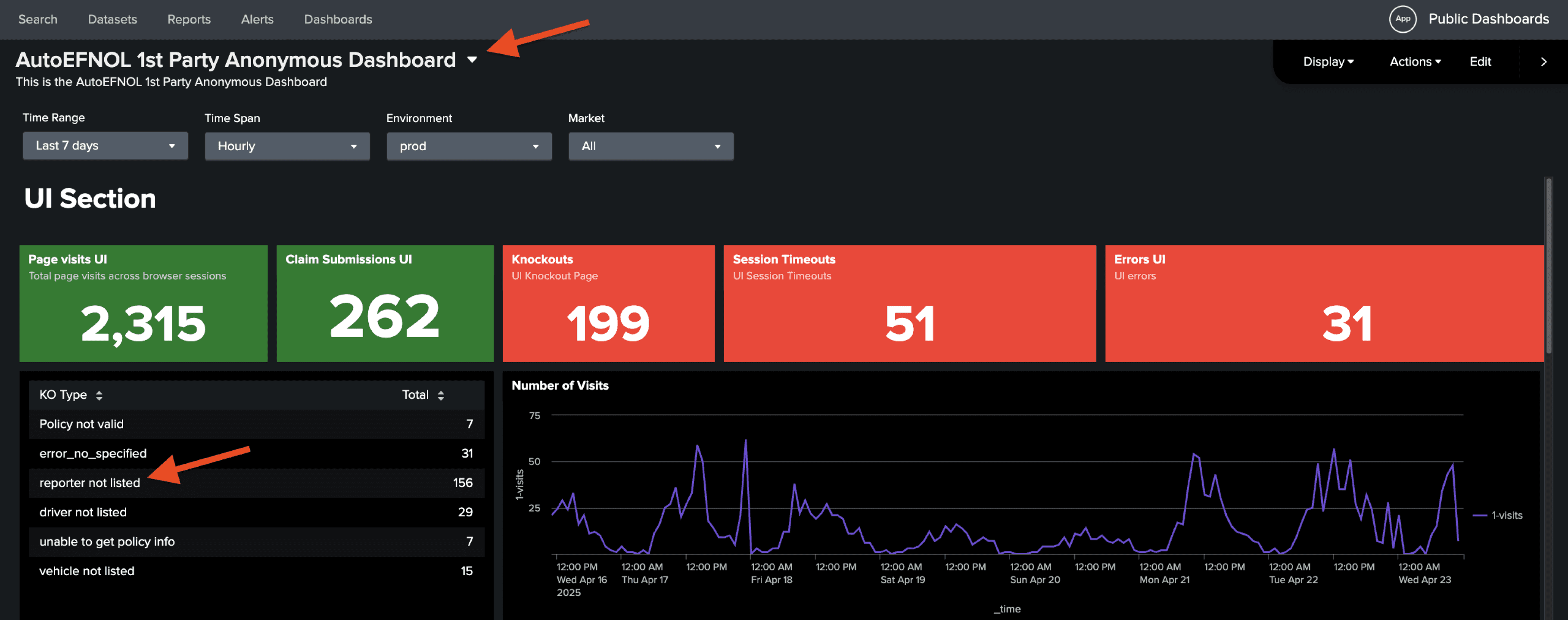

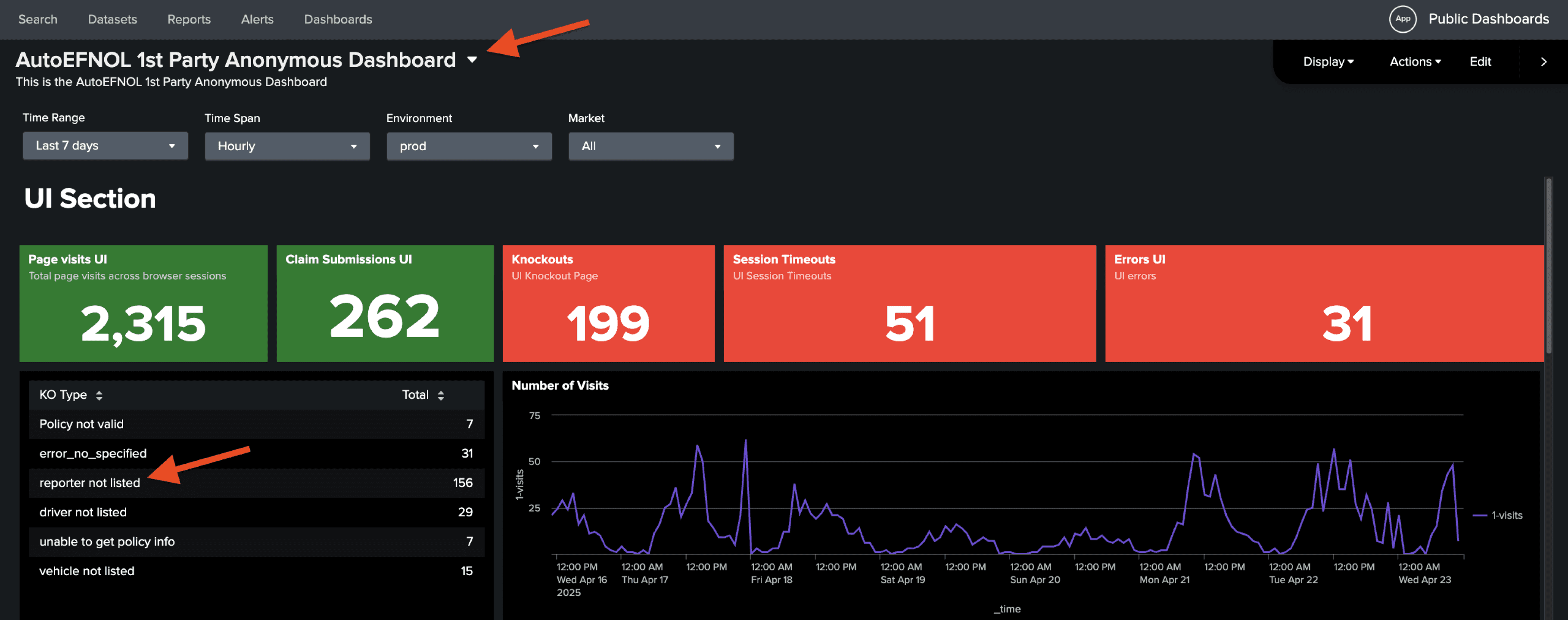

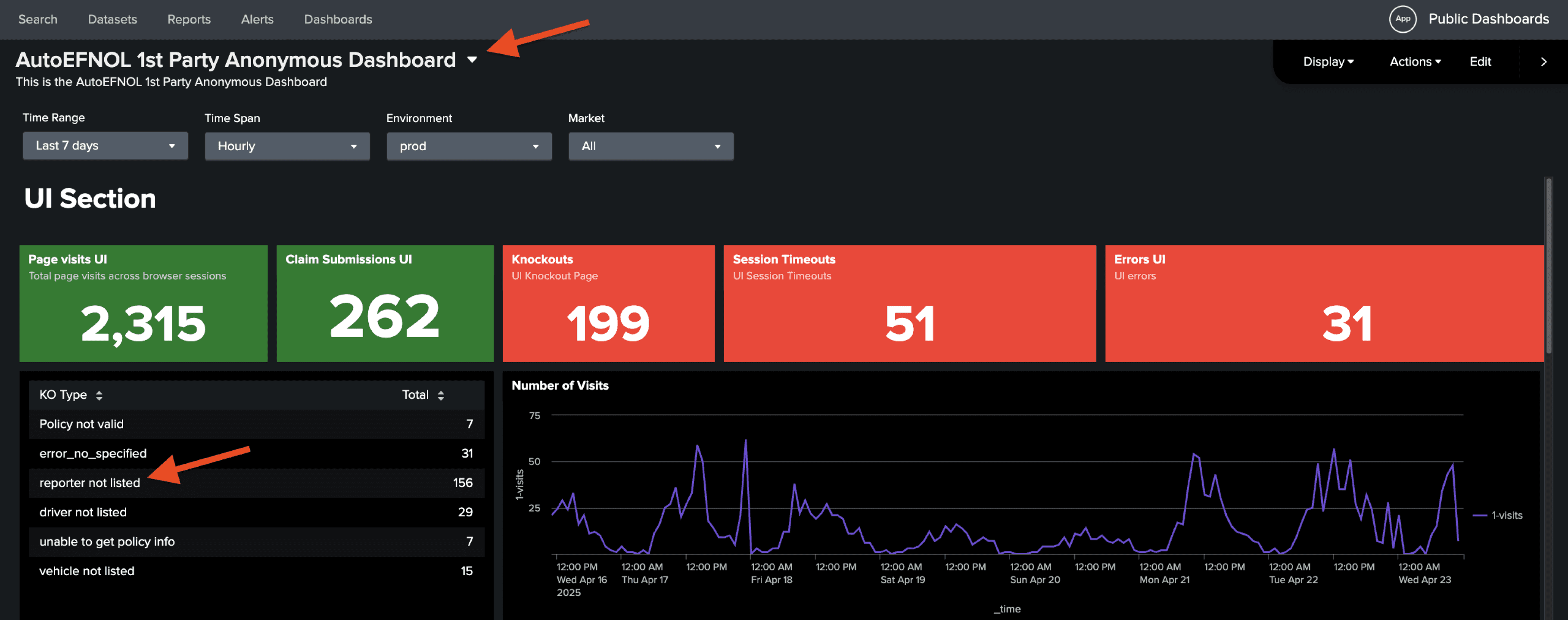

Before launching the product, we tested the entire flow using the beta link to ensure everything aligned with the final version. I collaborated with the development team to report and resolve both technical and visual issues.

Before launching the product, we tested the entire flow using the beta link to ensure everything aligned with the final version. I collaborated with the development team to report and resolve both technical and visual issues.

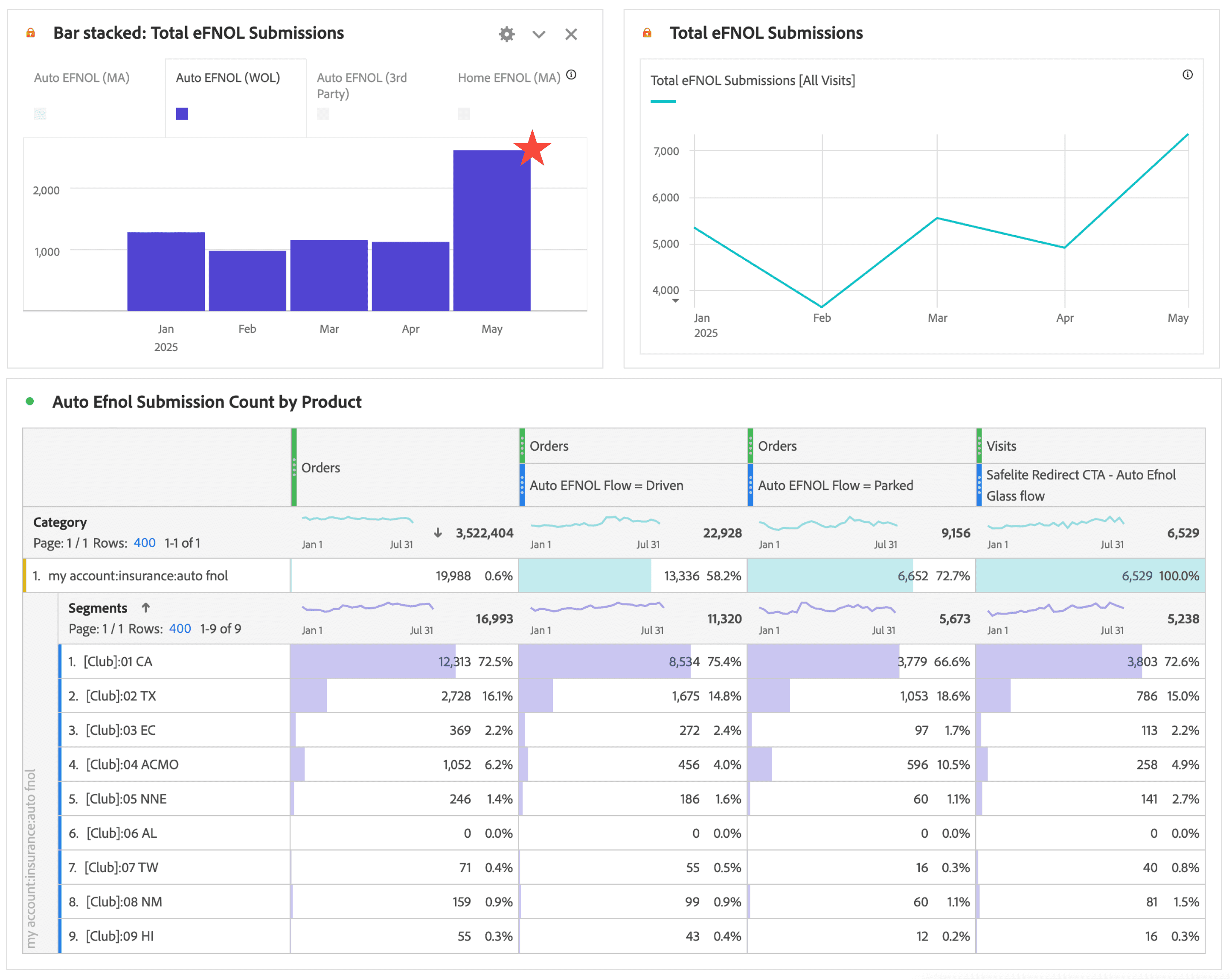

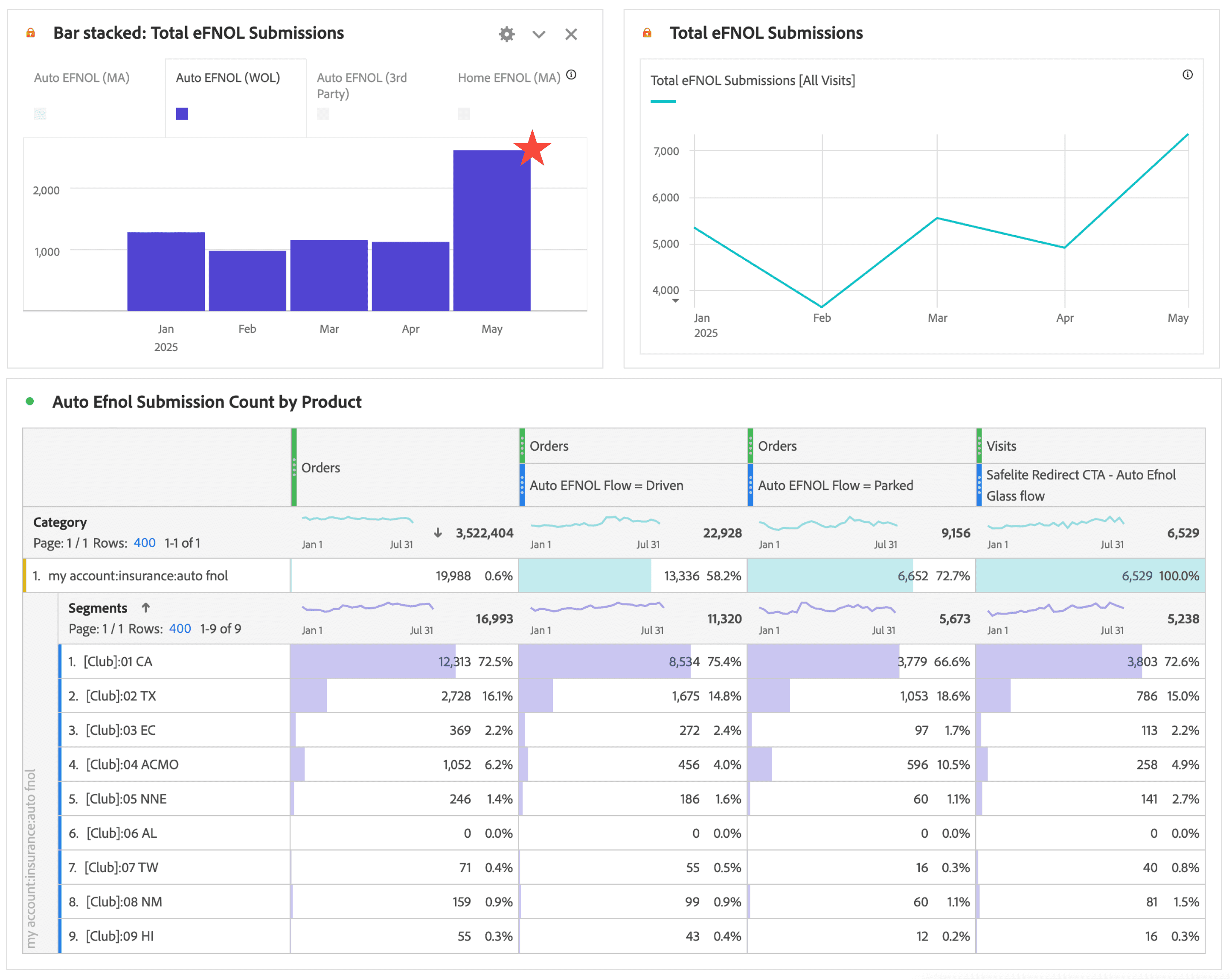

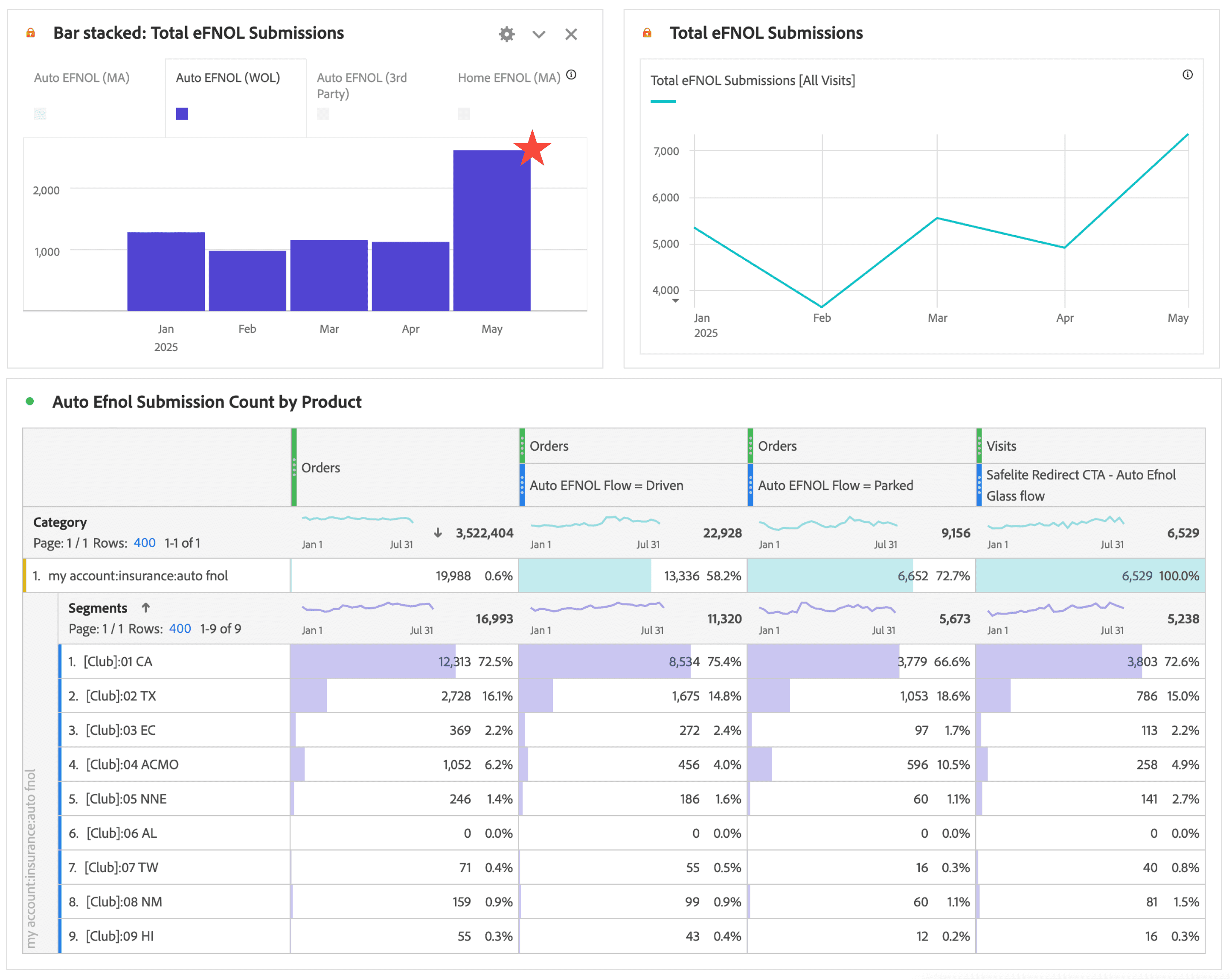

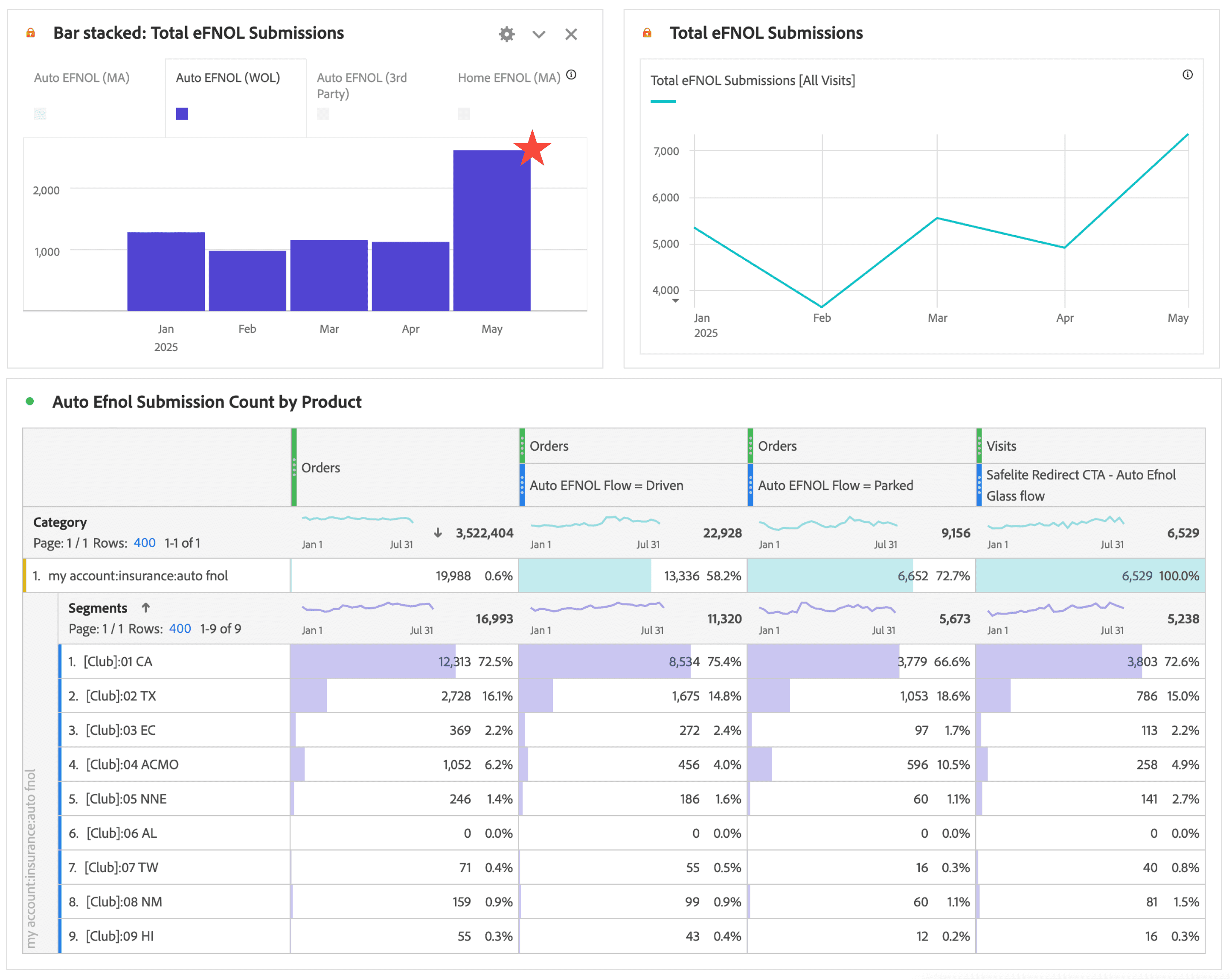

After lunch

After lunch

After lunch

After lunch

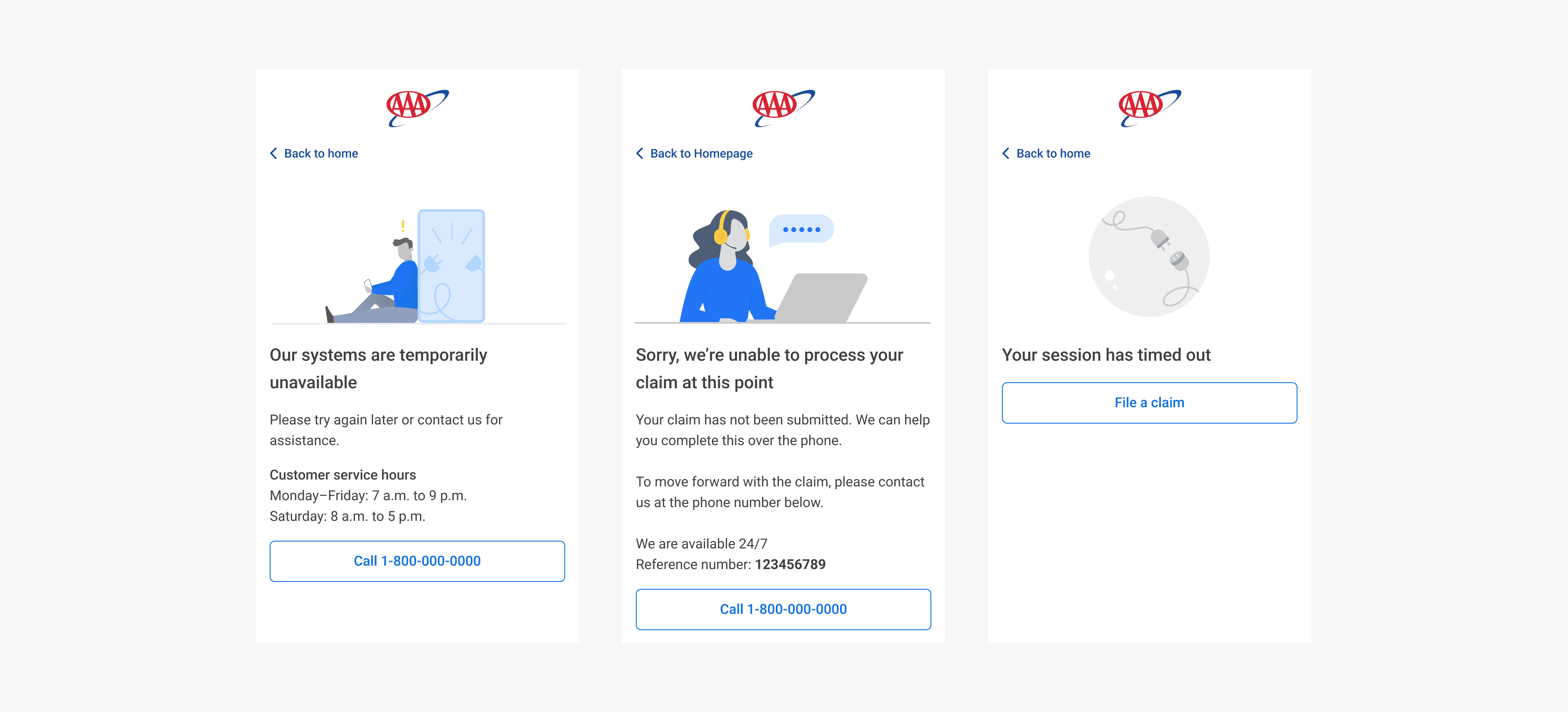

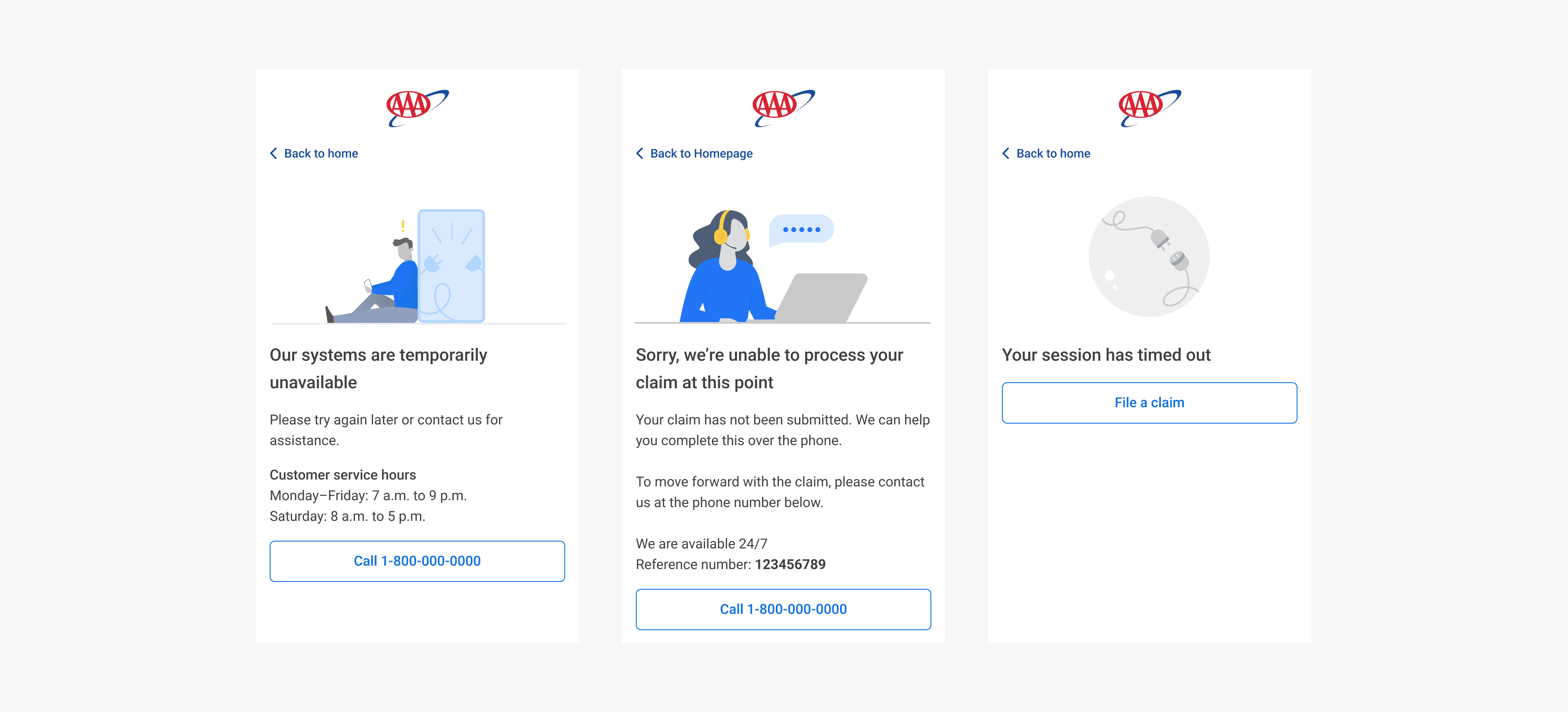

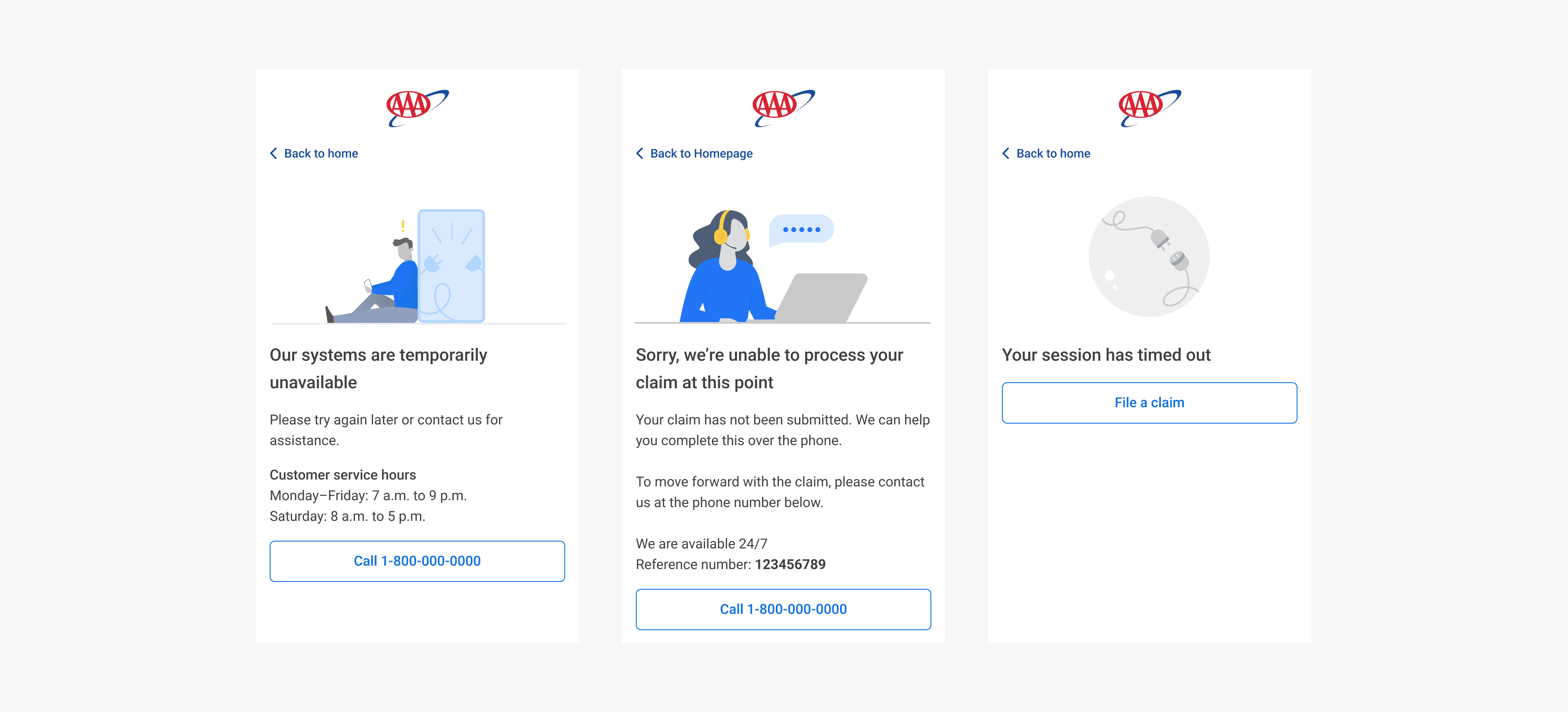

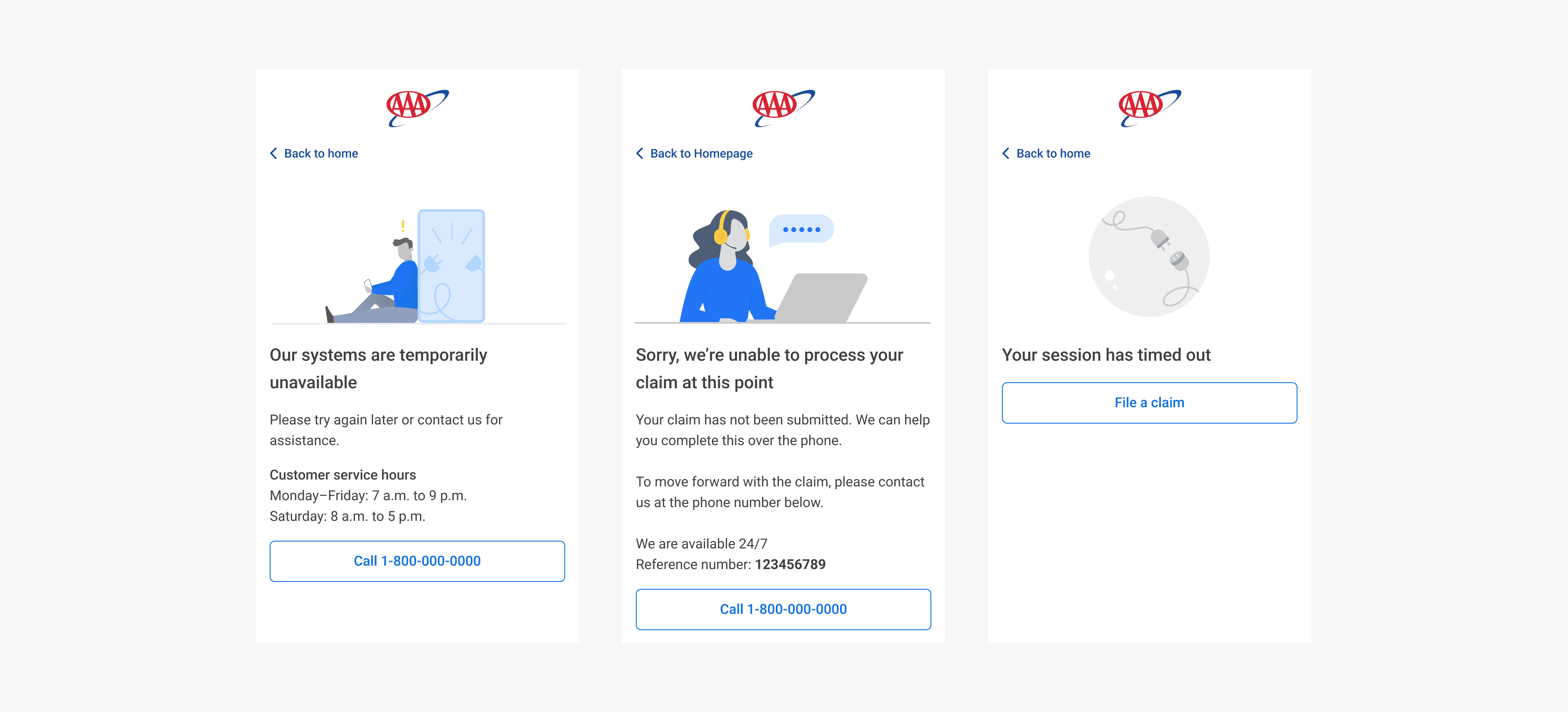

After launch, our team continuously monitored submissions, bugs, and errors. Based on the data, I designed additional screens to better guide users through their knockout scenarios. And reduce the drop rated for users.

Conclusion

Conclusion

Conclusion

Conclusion

Throughout the development of our online claim flow without login, we saw a significant increase in submission rates compared to early 2025. Following the success of this flow, the solution is planned to expand beyond AAA members to include third-party users such as law firms, other insurance policyholders, and representatives from partner companies.